Hey, In this blog I’m going to tell you How I Paid Off My Credit Card Debt in 3years. Yes, You heard it right. Various Tips & Strategies helped me to pay off my debts quickly, I will share those tips in this article. Five key points that summarize the blog post on How I Paid Off My Credit Card Debt of $50,000 in 3 Years: If you had asked me five years ago whether I would be able to pay off $50,000 in credit card debt, I would have laughed in your face. At that point in my life, I was drowning in credit card debt, struggling to make even the minimum payments on my credit cards. It seemed like no matter how hard I worked, I couldn’t make a dent in my debt. But then I hit rock bottom. My credit score was in the toilet, and I was receiving collection calls on a daily basis. I knew I needed to make a change, but I didn’t know where to start. So, I did what any millennial would do – I turned to Google. After hours of research, I stumbled upon the concept of “debt snowballing.” The idea was simple – you pay off your smallest debt first, and then use the money you were putting towards that debt to pay off the next smallest debt, and so on. It sounded like a no-brainer, but I was skeptical. How could such a simple idea work for someone with as much debt as I had? But I was desperate, so I decided to give it a try. I made a list of all my debts, from smallest to largest, and started attacking them one by one. I stopped using my credit cards altogether, and instead focused on living as frugally as possible. I cancelled my gym membership, stopped eating out, and started making my own coffee instead of buying it on my way to work. The first few months were tough. I felt like I was sacrificing everything, and yet my credit card debt seemed to be growing instead of shrinking. But I stuck with it, and slowly but surely, I started to see progress. My smallest debts were paid off within a few months, and suddenly I had a little bit of extra money each month to put towards my larger debts. After a year of living frugally and paying off my debts, I started to feel like I had a handle on my finances. I had a budget that I stuck to religiously, and I no longer felt like my debt was controlling my life. I even started to think about the future – something I had been too afraid to do when I was drowning in debt. Three years after I started my debt snowball, I made my final payment on my credit cards. It was a surreal moment – I had never felt so proud of myself. I had gone from feeling helpless and overwhelmed to feeling in control of my finances. And while I still live frugally and stick to a budget, I no longer feel like I’m sacrificing everything for the sake of my credit card debt. Looking back on my journey, I realize that the key to paying off my credit card debt was simple – it was all about taking small steps and staying committed. It wasn’t easy, and there were times when I wanted to give up. But I knew that if I stuck with it, I could achieve my goal. And I did. If I can pay off $50,000 in credit card debt, anyone can. It just takes a little bit of patience, a lot of hard work, and a willingness to make some sacrifices in the short term for a better financial future in the long term. Tools that can help you manage your credit card debt A Real-time Example of How I Paid Off My Credit Card Debt Let’s say you have four credit cards with balances of $5,000, $10,000, $15,000, and $20,000, totaling $50,000 in credit card debt. Using the debt snowball method, you would focus on paying off the credit card with the smallest balance first, in this case, the $5,000 balance. You would continue making the minimum payments on the other cards while putting as much extra money as possible towards paying off the $5,000 balance. Let’s say you can afford to put an extra $500 towards your debts each month. You would make the minimum payment on the $10,000 balance, plus the extra $500, until the $5,000 balance is paid off. Then, you would add the minimum payment from the $5,000 balance ($100, for example) to the extra $500 you were already putting towards your debts, giving you $600 to put towards your next smallest balance, the $10,000 balance. You would continue this pattern, paying off the $10,000 balance next, and then using the combined minimum payment and extra payment from the paid off cards to pay off the $15,000 balance, and finally using all of the money you were putting towards debt to pay off the largest $20,000 balance. Assuming you are able to put an extra $500 towards your debts each month, it would take approximately 3 years and 2 months to pay off the entire $50,000 debt, with interest included. Of course, this timeline may vary depending on your interest rates and the amount of extra money you are able to put towards your debts each month. 5 books that can help you learn how to handle debts common psychological factors that can come into play when dealing with credit card debt: Conclusion How I Paid Off My Credit Card Debt may seem daunting, but it is possible with a little bit of patience and commitment. By using the debt snowball method and focusing on paying off your smallest debts first, you can gain momentum and see progress in your debt repayment journey. It is also important to live

Affiliate marketing strategies and tips: Are you a blogger looking to monetize your website? Affiliate marketing may be just the solution you need. By promoting products or services on your blog and earning a commission for each sale made through your unique referral link, you can turn your passion for blogging into a profitable business. In this post, we will share some effective affiliate marketing strategies and tips to help you maximize your earning potential. Affiliate marketing strategies: Choose Products Relevant to Your Niche The key to success with affiliate marketing is to promote products or services that are relevant to your blog’s niche and audience. This not only ensures that your readers are interested in what you are promoting but also increases the chances of them making a purchase through your affiliate link. here are some points to consider when choosing products relevant to your niche: Consider your audience: Think about the demographics of your audience, their interests, and what they may be looking for from your blog. Choose products that align with their needs and desires. Look at your niche: Consider the topics you typically cover on your blog and the types of products that would naturally fit within those categories. For example, if you blog about health and wellness, promoting health supplements or fitness gear would be relevant. Research affiliate programs: Look for affiliate programs that offer products related to your niche. There are many affiliate networks and marketplaces that you can browse to find relevant products. Evaluate the product: Before promoting a product, evaluate its quality and value. Is it something you would use or recommend to others? Does it provide value to your audience? Avoid promoting products solely for the purpose of earning a commission. Consider your brand Affiliate marketing strategies : Promoting products that are relevant to your brand and align with your values and mission can help strengthen your reputation and build trust with your audience. Make sure the products you promote are consistent with your overall brand image. Be Honest and Transparent As a blogger, your readers trust your opinion and recommendations. It is important to be honest and transparent about your affiliate partnerships and only promote products that you genuinely believe in. This builds trust with your audience and can lead to more conversions in the long run. Use Multiple Platforms for Promotion Don’t limit yourself to promoting affiliate products only on your blog. Utilize social media platforms like Instagram, Facebook, and Twitter to reach a wider audience and increase your earning potential. You can also create YouTube videos or podcasts to promote your affiliate products. here are some points to keep in mind when using multiple Affiliate marketing strategies: Optimize Your Affiliate Content for SEO To increase your chances of ranking in search engines and driving organic traffic to your blog, it is essential to optimize your affiliate content for SEO. Use relevant keywords in your blog posts and meta descriptions, and create high-quality content that provides value to your readers. Track Your Results and Adjust Your Affiliate marketing strategies Track your affiliate links’ performance regularly and adjust your Affiliate marketing strategies accordingly. Use tools like Google Analytics to monitor your conversions, click-through rates, and earnings. This allows you to identify what is working and what isn’t, and make changes to improve your affiliate marketing efforts. Tracking your results and adjusting your strategy is crucial for optimizing your affiliate marketing efforts. Here are some points to consider when tracking your results and adjusting your strategy: By tracking your results and adjusting your Affiliate marketing strategies, you can optimize your affiliate marketing efforts, maximize your earning potential, and create a profitable business through your blog. In conclusion, Affiliate marketing strategies can be a lucrative way for bloggers to monetize their website. By choosing relevant products, being honest and transparent, using multiple platforms for promotion, optimizing your content for SEO, and tracking your results, you can maximize your earning potential and turn your blog into a profitable business.

Are you looking to Sell your skills to Make money from the comfort of your own home? Selling your skills online can be a great way to do so. With the rise of the gig economy and the proliferation of online platforms, it’s never been easier to monetize your talents and expertise. In this step-by-step guide, we’ll walk you through the process of selling your skills online and making money. Perhaps it’s time to turn your focus inward and start investing in yourself. Upgrading your skills and knowledge can lead to a more fulfilling career, and ultimately, financial success. Here’s why investing in yourself is the best investment you can make: Your Skills are Your Greatest Asset In today’s ever-changing job market, your skills are your most valuable asset. Investing in your skills and upgrading your knowledge can lead to greater opportunities for career advancement and financial gain. By focusing on your own personal and professional development, you can increase your earning potential and position yourself for long-term success. You Control Your Own Destiny Investing in yourself means taking control of your own future. By continuously learning and growing, you become less dependent on external factors like the stock market or the economy. You can create your own opportunities and take your career in the direction you want it to go. The Benefits are Long-Term Investing in yourself pays dividends for years to come. The skills and knowledge you acquire stay with you for life, and can help you navigate the ever-changing job market. Plus, upgrading your skills can increase your confidence, boost your creativity, and improve your overall quality of life. It’s More Reliable Than the Stock Market As you mentioned in your input, financial predictions in the stock market can be unreliable. Investing in yourself is a more reliable way to achieve financial success. By improving your skills and knowledge, you increase your value in the job market and make yourself more employable. You don’t have to worry about market fluctuations or external factors that are out of your control. How to sell your skills online & Make money Step 1: Identify and Sell Your Skills Online The first step is to identify and sell your skills online. Do you have expertise in graphic design, writing, programming, social media marketing, or some other field? Once you know what skills you have to offer, you can start looking for platforms that match your skills with potential clients. Step 2: Choose the right platform to Sell Your Skills Online There are a variety of online platforms that allow you to sell your skills, such as Upwork, Fiverr, and Freelancer.com. Each platform has its own strengths and weaknesses, so it’s important to do your research and choose the one that best fits your skills and needs. Consider factors like fees, competition, and the types of clients who use the platform. Top 10 Online platforms to Sell Your Skills Online Here are 10 online platforms where you can Sell Your Skills online: Upwork: Upwork is a freelance marketplace where businesses and individuals can hire freelancers for a wide range of projects, from web development and graphic design to writing and virtual assistant work. Fiverr: Fiverr is a platform that connects freelancers with businesses and individuals in need of various services, including graphic design, video production, and copywriting. Etsy: Etsy is an e-commerce platform that enables artisans and craftspeople to sell their handmade or vintage goods directly to buyers around the world. Airbnb: Airbnb is a popular online marketplace where people can rent out their homes or apartments to travelers looking for short-term lodging. YouTube: YouTube is a video-sharing platform where content creators can earn money through ads, sponsorships, and other revenue streams. Amazon Mechanical Turk: Amazon Mechanical Turk is a crowdsourcing platform where businesses can outsource simple, repetitive tasks to a global workforce. Udemy: Udemy is an online learning platform that allows instructors to create and sell courses on a wide range of topics, from business and technology to health and fitness. Shutterstock: Shutterstock is a stock photography and video marketplace where photographers and videographers can upload their content and earn money through licensing and downloads. Rover: Rover is a platform that connects pet owners with pet sitters and dog walkers, enabling people to earn money by providing pet care services. TaskRabbit: TaskRabbit is a platform that connects people in need of various services, such as home cleaning, handyman work, and errand running, with skilled taskers who can provide those services for a fee. Top 10 Offline platforms to Sell Your Skills Online Babysitting: Babysitting is a popular way to Sell Your Skills Online by watching children for parents who need to work or go out for the evening. Dog walking and pet sitting: Similar to babysitting, dog walking and pet sitting are in-demand services that can help you earn money by taking care of pets while their owners are away. Lawn care and landscaping: If you enjoy working outdoors, you can offer your services for lawn care and landscaping to homeowners in your local community. Freelance photography: If you have a talent for photography, you can offer your services for events like weddings, parties, and portraits. Home cleaning: Many people are willing to pay for help with cleaning their homes, so offering home cleaning services can be a lucrative opportunity. Personal shopping and styling: If you have a knack for fashion and shopping, you can offer personal shopping and styling services to people who want help with their wardrobe. Handyman services: If you are skilled at fixing things around the house, you can offer handyman services to homeowners in your community. Personal training: If you are passionate about fitness and exercise, you can offer personal training services to people who want to get in shape and stay healthy. Music lessons: If you are skilled at playing an instrument, you can offer music lessons to people who want to learn how to play. Tutoring: If you are knowledgeable in a particular

Photo by Sasun Bughdaryan on Unsplash Are you tired of feeling like you’re always living paycheck to paycheck? Do you struggle to How to save money every month? If so, you’re not alone. Many people struggle with the same issue. Fortunately, there are steps you can take to save money and improve your financial situation. Start with an Example Now we can see a real-time example to save your money every month, Do you like coffee? One practical example of how to save money is by cutting back on your daily coffee habit. If you’re used to buying a $4 coffee every day, that adds up to $120 per month. Instead, consider brewing your own coffee at home or at work. Invest in a good quality coffee maker and buy your favorite coffee beans in bulk. This way, you can still enjoy your morning cup of joe without spending a lot of money. Over the course of a year, this small change could save you up to $1,440! Another practical example of how to save money is by buying generic or store-brand products instead of name-brand products. Often, the generic or store-brand products are just as good as the name-brand products, but at a much lower cost. You can save money on groceries, cleaning products, and other household items by choosing the generic or store-brand option. Over time, these small savings can add up to a significant amount of money. Okay, Let’s get into this blog post, we’ll cover some practical tips on how to save money every month. Create a budget The first step to saving money is creating a budget. This will help you understand where your money is going each month and identify areas where you can cut back. Start by listing all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Then, compare your total expenses to your income. If you’re spending more than you’re earning, you’ll need to make some adjustments. Use Spreadsheets or Budgeting application creating a budget done by using a spreadsheet or budgeting app. Start by listing all of your monthly income sources, such as your salary, freelance work, or any other sources of income. Then, list all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Assign a dollar amount to each expense category and subtract the total expenses from the total income to see if you have a surplus or deficit. This will give you a clear picture of where your money is going each month and where you may need to adjust your spending. You can also use a budgeting app like Mint or YNAB to automatically track your spending and categorize your expenses. This way, you can easily see how much you’re spending in each category and identify areas where you can cut back. Cut back on unnecessary expenses Once you’ve created a budget, look for ways to cut back on unnecessary expenses. For example, do you really need that gym membership you never use? Or, could you save money by cooking at home instead of eating out? Look for small changes you can make that will add up over time. Set financial goals & save money Setting financial goals is a great way to stay motivated and on track. Start by setting a savings goal for each month. This could be as simple as saving $50 or $100. As you become more comfortable with saving, you can increase your goals. One practical example of setting financial goals is creating an emergency fund. This fund can be used to cover unexpected expenses, such as car repairs or medical bills, without having to rely on credit cards or loans. Start by setting a goal to save a certain amount, such as $1,000 or $2,000, and then make a plan to reach that goal. You can set up automatic transfers from your checking account to your emergency fund each month, or allocate a portion of your tax refund or bonus to the fund. By setting this financial goal and making a plan to achieve it, you’ll be prepared for unexpected expenses and avoid going into debt. Use apps and tools to help you save money There are many apps and tools available that can help you save money. For example, some apps will automatically save small amounts of money from your checking account each week. Others will help you find coupons and deals to save money on your purchases. I will Suggest Wallet & Bluecoins Mobile applications to track your money. I’m using these two tools for the past two years. It’s amazing. Pay yourself first One of the most effective ways to save money is to pay yourself first. This means setting aside a portion of your income for savings before you pay your bills or spend money on anything else. Even if it’s just a small amount, paying yourself first will help you develop the habit of saving. Conclusion: How to save money every month Expense Category Monthly Expense Money-Saving Strategies Housing $1,200 (rent) Consider downsizing to a smaller apartment or finding a roommate to split rent costs. Utilities $150 Turn off lights and electronics when not in use, adjust thermostat by a few degrees, switch to energy-efficient light bulbs. Transportation $200 Carpool to work, walk or bike instead of driving short distances, use public transportation. Food $500 Plan meals in advance and make a grocery list, cook at home instead of eating out, buy generic or store-brand products. Entertainment $100 Look for free or low-cost activities, such as hiking or visiting museums, instead of expensive outings. Total Monthly Expenses $2,150 Money-Saving Goal: Reduce monthly expenses by 10% by cutting back on unnecessary expenses and finding ways to save money. Sample Monthly Budgeting By identifying your monthly expenses and finding ways to reduce them, you can set a goal to save a certain percentage each month. In this example, the goal is to reduce monthly expenses by 10% and

Introduction Investing is the act of putting money to work to generate returns over time. The goal of investing is to increase your wealth through the appreciation of your investment over time. Investing can take many forms, including stocks, bonds, mutual funds, real estate, and alternative investments. The key is to have a plan in place to build wealth through investing Briefly explain what investing is and why it’s important for building wealth through investing Investing is the act of allocating resources, such as money, time, or effort, with the expectation of generating a return in the future. The return on investment can take many forms, including capital appreciation, income, or both. Investing is critical for building wealth because it allows you to grow your money over time through the power of compounding. By investing your money wisely, you can generate a return that exceeds inflation and provides financial security and independence over the long term. Mention the different types of investments There are various types of investments available to investors, including: Stocks Bonds Mutual Funds Exchange-Traded Funds (ETFs) Real Estate Alternative Investments Certificates of Deposit (CDs) Options and Futures Stocks: Ownership in a company that entitles the holder to a portion of its earnings and assets. Bonds: A debt investment where the investor loans money to an entity, usually a corporation or government, that borrows the funds for a defined period and pays interest to the investor. Mutual Funds: A professionally managed investment fund that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks. Real Estate: Investment in properties such as homes, apartment buildings, or commercial buildings, with the expectation of generating income or capital gains. Alternative Investments: Investments that don’t fit into traditional asset classes, such as commodities, private equity, hedge funds, and art. Certificates of Deposit (CDs): Savings certificates issued by banks or credit unions that pay a fixed interest rate for a specific period. Options and Futures: Contracts that give the holder the right or obligation to buy or sell a security or commodity at a predetermined price and date in the future. It’s important to note that each investment type has its unique risks and potential rewards, and investors should choose investments that align with their financial goals and risk tolerance Setting Financial Goals Before investing, it’s essential to have a clear understanding of your financial goals. Whether it’s saving for retirement, buying a home, or paying off debt, setting goals helps you stay focused and motivated. Your financial goals will help you determine your investment strategy, asset allocation, and risk tolerance. Explain why setting financial goals is important for investing Setting financial goals is crucial for investing because it helps investors determine their investment strategy, asset allocation, and risk tolerance. Without clear financial goals, investors may not know how much money they need to invest, how much risk they can take, or how long they need to hold their investments. Financial goals can vary widely from person to person, and they can include saving for retirement, buying a home, paying off debt, or generating income. By setting specific financial goals, investors can determine how much money they need to invest, how much risk they can tolerate, and how long they need to hold their investments to achieve their goals. Having clear financial goals can also help investors stay disciplined and motivated during market fluctuations. During market downturns, for example, it can be tempting to sell investments and move to cash. However, if investors have a clear investment plan aligned with their financial goals, they are more likely to stay invested and ride out market volatility. In summary, setting clear financial goals is important for investing because it helps investors determine their investment strategy, asset allocation, and risk tolerance, stay disciplined during market fluctuations, and achieve their financial objectives over the long term. Provide examples of financial goals and how to set them Here are some examples of financial goals and how to set them: Retirement Saving for a down payment Paying off debt Building an Emergency fund Retirement: One of the most common financial goals is to save enough money to retire comfortably. To set this goal, you should consider factors such as your current age, desired retirement age, lifestyle expectations, and retirement income sources. You can then calculate the amount of money you need to save to achieve your retirement income goals and determine an investment strategy and timeline to reach that amount. Saving for a Down Payment: Another financial goal could be to save for a down payment on a home. To set this goal, you should consider factors such as the price of the home you want to buy, the down payment percentage required by the lender, and the timeline for purchasing the home. Once you know how much money you need to save, you can determine a monthly savings amount and investment strategy to reach your goal within your desired timeframe. Paying off Debt: Some financial goals may involve paying off debt, such as credit card balances or student loans. To set this goal, you should consider the total amount of debt you have, the interest rates, and the minimum payments required. You can then determine a payment plan and investment strategy to pay off the debt as quickly as possible. Building an Emergency Fund: Another financial goal could be to build an emergency fund to cover unexpected expenses, such as a medical emergency or job loss. To set this goal, you should consider your monthly expenses and the amount of money you would need to cover three to six months of living expenses. You can then determine a monthly savings amount and investment strategy to build your emergency fund over time. When setting financial goals, it’s important to be specific, measurable, and realistic. It’s also helpful to break larger goals into smaller, achievable milestones to stay

Image by freepik Retirement planning is an essential aspect of financial planning that often takes a back seat in our busy lives. However, it is crucial to start planning and saving for retirement as early as possible to ensure a comfortable and stress-free retirement. Here are five retirement planning strategies to maximize your savings and secure your financial future. Start Saving Early The earlier you start saving for retirement, the more time your money has to grow. Even small contributions made consistently over a long period can add up to a significant sum. For example, if you start saving $100 a month in a retirement account at the age of 25, assuming an average annual return of 7%, you could accumulate over $360,000 by the time you reach 65. However, if you wait until you are 35 to start saving the same amount, you would accumulate only about $160,000 by the time you reach 65. Make the Most of Employer-Sponsored Retirement Plans Many employers offer retirement plans such as 401(k)s or 403(b)s, which allow employees to contribute a portion of their pre-tax income to a retirement account. In addition, many employers offer matching contributions up to a certain percentage of an employee’s salary. To maximize your savings, contribute at least enough to receive the full matching contribution from your employer. Also, consider increasing your contribution rate as you get older and your income increases. Diversify Your Retirement Portfolio Investing in a diversified portfolio of assets, such as stocks, bonds, and real estate, can help to mitigate risks and increase the potential for long-term growth. A balanced and diversified retirement portfolio can also help to ensure that you are not overly exposed to any single asset class or industry. As you near retirement age, consider adjusting your asset allocation to a more conservative mix of investments to reduce risk. Minimize Investment Fees Investment fees, such as management fees and expense ratios, can eat into your retirement savings over time. To minimize fees, consider investing in low-cost index funds or exchange-traded funds (ETFs) rather than actively managed funds. Also, be sure to review the fees associated with any investment accounts or financial advisors you use and negotiate for lower fees when possible. Plan for Healthcare Costs Healthcare costs can be a significant expense in retirement. According to Fidelity Investments, a 65-year-old couple retiring in 2020 can expect to spend an estimated $295,000 on healthcare expenses in retirement. To prepare for these costs, consider investing in a Health Savings Account (HSA) if you are eligible. HSAs offer tax-free contributions and withdrawals for qualified healthcare expenses, and unused funds can be carried over from year to year. In conclusion, maximizing your retirement savings requires discipline, planning, and a long-term perspective. By starting early, taking advantage of employer-sponsored retirement plans, diversifying your retirement portfolio, minimizing investment fees, and planning for healthcare costs, you can increase your chances of achieving a comfortable and secure retirement. Remember, it’s never too early or too late to start planning for retirement, and every little bit you save can make a significant difference in the long run.

Image by freepik As a small business owner, tax season can be a stressful time. But with some smart tax planning and a few key strategies, you can save money on your taxes and keep more of your hard-earned profits. Here are 10 smart tax saving tips for small business owners: Deduct business expenses One of the most basic ways to save money on your taxes is to deduct your business expenses. Keep careful records of all your business expenses throughout the year, including office supplies, equipment, travel expenses, and more. These deductions can add up quickly and reduce your taxable income, saving you money on your taxes. Maximize your retirement contributions Contributing to a retirement plan can be a great way to save money on taxes while also investing in your future. Maximize your contributions to your retirement plan each year to take advantage of the tax benefits. For example, contributions to a traditional IRA or 401(k) plan are tax-deductible, reducing your taxable income for the year. Hire your spouse or children If you have a spouse or children who are able to work in your business, consider hiring them as employees. This can help reduce your taxable income by shifting some of your income to your family members. Plus, it can be a great way to teach your children about business and finances while also providing them with valuable work experience. Consider a home office deduction If you work from home, you may be eligible for a home office deduction. This deduction allows you to deduct a portion of your home expenses, such as mortgage interest, utilities, and insurance, based on the percentage of your home that is used for business. Be sure to follow the IRS guidelines for claiming this deduction, and keep careful records of your expenses. Take advantage of Section 179 Section 179 of the tax code allows businesses to deduct the full cost of qualifying equipment and software purchases in the year they are made, rather than depreciating them over time. This can be a great way to save money on taxes while also investing in your business. Consider a Health Savings Account (HSA) If you have a high-deductible health plan, consider opening a Health Savings Account (HSA). Contributions to an HSA are tax-deductible, and withdrawals are tax-free if used for qualified medical expenses. This can be a great way to save money on taxes while also providing a safety net for unexpected medical expenses. Maximize your business tax credits There are many tax credits available to small businesses, such as the research and development tax credit, the work opportunity tax credit, and the employer-provided child care credit. Be sure to explore all the available tax credits and take advantage of them to reduce your tax bill. Donate to charity Charitable donations can be a great way to save money on taxes while also supporting a good cause. If you make a donation to a qualified charitable organization, you can deduct the donation on your tax return. Be sure to keep records of your donations and get receipts from the organizations you donate to. Keep up with tax law changes Tax laws and regulations are constantly changing, so it’s important to stay up-to-date on the latest developments. Work with a tax professional or use reliable sources of information to keep informed about changes that may impact your business. Plan ahead Finally, the best way to save money on your taxes is to plan ahead. Keep track of your income and expenses throughout the year, and work with a tax professional to develop a tax strategy that works for your business. By planning ahead, you can reduce your tax bill and keep more of your hard-earned profits. In conclusion, as a small business owner, you have many options to save money on taxes. By taking advantage of deductions, maximizing your retirement contributions, hiring family members, considering a home office deduction, using Section 179, and exploring tax credits, you can significantly reduce your taxable income. Additionally, opening a Health Savings Account, donating to charity, staying informed about tax law changes, and planning ahead can all help you save money on taxes. Remember, it’s essential to keep accurate records of all your expenses, income, and deductions. This will help you file your tax return accurately and avoid penalties for errors or discrepancies. Work with a tax professional if you need help navigating the tax code and developing a tax strategy for your business. By implementing these smart tax-saving tips, you can keep more of your hard-earned money and invest in the growth and success of your business.

In today’s world, it’s important to take control of your finances and create a budget that works for you and your lifestyle. Budgeting can help you maximize your income, save money, and achieve your financial goals. However, creating a budget can seem daunting, especially if you’re not sure where to start. In this blog post, we’ll discuss how to create a budget that works for you and your lifestyle. Step 1: Calculate Your Income The first step in creating a budget is to calculate your income. This includes your salary, bonuses, and any other sources of income. It’s important to be accurate when calculating your income, as this will help you determine how much you can afford to spend and save each month. Step 2: Track Your Expenses The next step is to track your expenses. This includes everything from rent and utilities to groceries and entertainment. You can use a spreadsheet or budgeting app to track your expenses, or simply write them down on a piece of paper. The key is to be as detailed as possible and to include all of your expenses. Step 3: Categorize Your Expenses Once you’ve tracked your expenses, it’s time to categorize them. This will help you see where your money is going and where you can cut back. Common expense categories include housing, transportation, food, entertainment, and debt payments. Step 4: Set Goals Now that you know how much you’re earning and spending, it’s time to set some financial goals. These goals can include things like paying off debt, saving for a down payment on a house, or investing for retirement. It’s important to set realistic goals that you can achieve within a reasonable timeframe. Step 5: Create a Budget With all of this information in hand, it’s time to create a budget. Start by listing your income at the top of the page, then subtract your expenses. If you have money left over, this is your disposable income. If you’re in the red, it’s time to look for ways to cut back on expenses or increase your income. Step 6: Monitor Your Budget Creating a budget is just the first step. You also need to monitor your budget regularly to ensure you’re staying on track. This means tracking your expenses and income each month and making adjustments as needed. You may also want to set up alerts or reminders to help you stay on top of your budget. Maximizing your income is all about taking control of your finances and creating a budget that works for you and your lifestyle. By following these steps, you can create a budget that will help you achieve your financial goals and live the life you want. Remember, budgeting is a process, so don’t be afraid to make adjustments and try new things until you find a budget that works for you.

Building wealth is a long-term process that requires consistent effort and discipline. It’s not about getting rich overnight, but rather developing habits that help you grow your wealth gradually over time. Here are five simple habits that can help you build wealth: Budgeting and Saving One of the most important habits for building wealth is to create a budget and stick to it. A budget helps you understand your income and expenses, allowing you to identify areas where you can save money. With a clear understanding of your finances, you can start setting aside money for savings and investments. A good rule of thumb is to save at least 20% of your income each month. Investing Investing is one of the most effective ways to build wealth over the long term. By putting your money into stocks, bonds, mutual funds, or real estate, you can earn a return on your investment that grows over time. It’s important to remember that investing always carries some level of risk, so it’s important to diversify your portfolio and invest in assets that align with your financial goals and risk tolerance. Living Within Your Means Living within your means is another essential habit for building wealth. This means avoiding debt and living a lifestyle that is sustainable on your current income. This doesn’t mean you have to sacrifice all of life’s pleasures, but rather being mindful of your spending and avoiding impulse purchases. Continuous Learning To build wealth, you need to stay informed about the latest financial trends and strategies. This means taking the time to read financial news, books, and blogs, as well as attending workshops and seminars. Continuous learning helps you stay on top of your finances and make informed decisions about your investments and financial goals. Surround Yourself with Like-Minded People Finally, building wealth is easier when you surround yourself with people who have similar financial goals and habits. This could mean joining a financial group or club, attending networking events, or even just spending time with friends who share your values around money. Surrounding yourself with like-minded people helps you stay motivated and accountable, making it easier to stick to your financial goals. In conclusion, building wealth is a long-term process that requires consistent effort and discipline. By implementing these simple habits into your daily life, you can create a solid foundation for financial success and build the wealth you deserve.

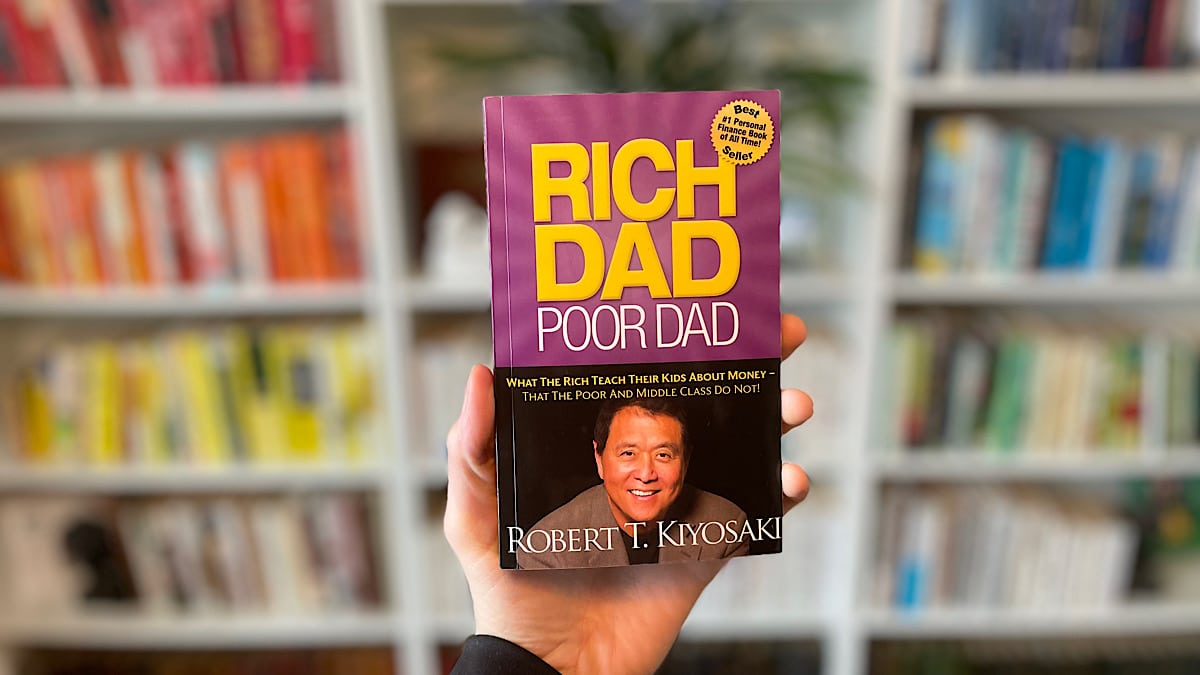

“Rich Dad Poor Dad” is a book written by Robert Kiyosaki that has had a significant impact on personal finance and wealth creation. Published in 1997, it has sold over 32 million copies in over 40 languages worldwide, making it one of the most popular personal finance books ever written. This book is written in a storytelling format and is based on Kiyosaki’s personal experiences with his own “rich dad” and “poor dad.” The main premise of the book is that financial education is not taught in schools, and many people are not equipped with the knowledge and skills to manage their finances effectively. The book offers a different perspective on money and wealth, challenging traditional beliefs about work, saving, and investing. In the book, Kiyosaki shares two contrasting stories of his two fathers – his biological father, who he refers to as the “poor dad,” and his friend’s father, who he calls the “rich dad.” He uses their stories to illustrate different approaches to money management and financial education. Kiyosaki’s poor dad was a highly educated man who worked hard and had a good job but struggled financially. He believed in getting a good education, getting a stable job, and saving money for retirement. His rich dad, on the other hand, was a self-made millionaire who had built his wealth through entrepreneurship and investing. One of the key takeaways from the book is the importance of financial literacy. Kiyosaki argues that financial literacy is not just about knowing how to budget and save money, but also about understanding the difference between assets and liabilities, understanding taxes, and understanding how to use leverage to build wealth. Kiyosaki also highlights the importance of investing in assets that generate income, such as real estate or stocks, rather than just saving money in a bank account. He emphasizes the value of taking calculated risks and stepping outside of one’s comfort zone to create wealth. Another important message from the book is the concept of “paying yourself first.” Kiyosaki argues that people should prioritize investing in themselves and their financial future by setting aside a portion of their income for investing, rather than just living paycheck to paycheck. The book also challenges the traditional idea of job security and encourages readers to explore entrepreneurship and creating their own businesses. Kiyosaki argues that relying solely on a job for income is risky, and that building one’s own business can provide more financial freedom and stability. Overall, “Rich Dad Poor Dad” offers a fresh perspective on personal finance and wealth creation, challenging traditional beliefs and offering practical advice for building wealth. The book emphasizes the importance of financial education, investing in assets that generate income, and taking calculated risks to achieve financial freedom.