Insurance is a topic that often gets overlooked until the unexpected happens. Yet, understanding and having the right insurance coverage is essential for safeguarding your financial well-being and providing peace of mind. In this blog, we’ll explore the importance of insurance, the types of insurance available, and how to make informed decisions to protect yourself, your loved ones, and your assets. 1. The Purpose of Insurance At its core, insurance is a risk management tool. It helps individuals and businesses mitigate the financial impact of unforeseen events such as accidents, illnesses, natural disasters, and more. By paying a relatively small premium, you transfer the potential financial burden of a significant loss to an insurance company. 2. Types of Insurance There is a wide range of insurance types available, each serving a specific purpose. Here are some common types of insurance to consider: a. Health Insurance: This is crucial for covering medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care. Health insurance ensures that you receive the necessary care without facing overwhelming costs. b. Life Insurance: Life insurance provides financial support to your beneficiaries in the event of your passing. It helps protect your family’s financial future by covering funeral expenses, paying off debts, and replacing lost income. c. Auto Insurance: Auto insurance covers the cost of damages in case of accidents, theft, or other incidents involving your vehicle. It also provides liability coverage to protect you from legal claims. d. Homeowners/Renters Insurance: Homeowners insurance protects your home and belongings from damage due to fire, theft, or other covered events. Renters insurance covers your personal property in a rented space and provides liability coverage. e. Disability Insurance: Disability insurance replaces a portion of your income if you become disabled and are unable to work. It ensures that you can continue to meet your financial obligations even during challenging times. 3. Assessing Your Insurance Needs To determine the right insurance coverage for your needs, it’s essential to assess your current financial situation, future goals, and potential risks. Consider factors such as your health, family situation, assets, and career. Consult with insurance professionals who can help you tailor a coverage plan that aligns with your unique circumstances. 4. Review and Adjust As your life evolves, so do your insurance needs. Regularly review your insurance policies to ensure they still provide adequate coverage. Major life events like getting married, having children, buying a home, or changing careers may require adjustments to your insurance coverage. Conclusion Insurance is a vital aspect of financial planning. It’s a proactive step toward protecting yourself and your loved ones from unforeseen challenges. By understanding the different types of insurance, assessing your needs, and regularly reviewing your coverage, you can navigate the complex world of insurance with confidence. Remember, the right insurance today can make all the difference in securing your future tomorrow.

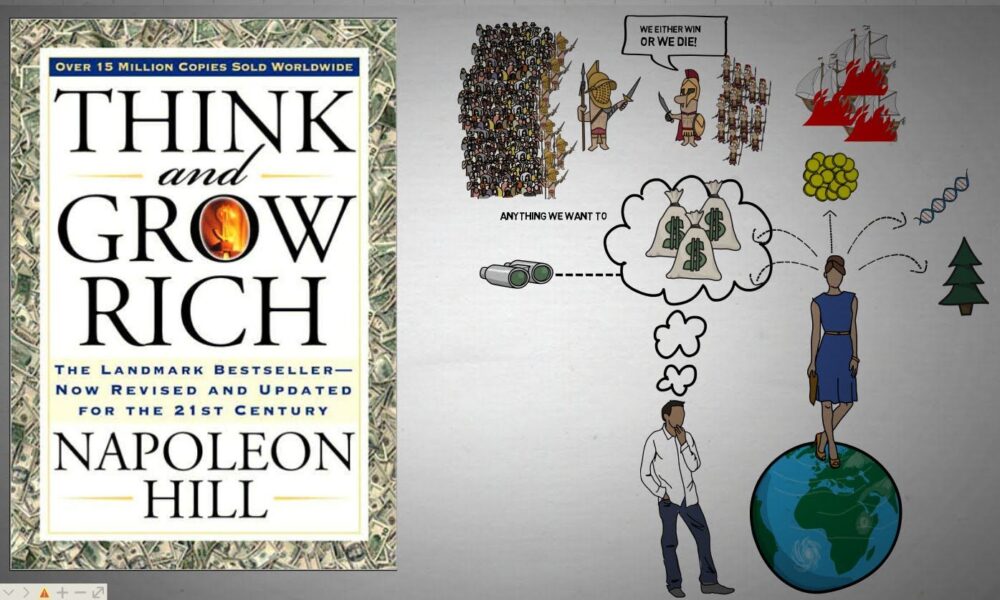

Are you ready to embark on a transformative journey that has the potential to reshape your understanding of success, wealth, and the power of your own mind? Look no further than the timeless classic “Think and Grow Rich” by Napoleon Hill. This groundbreaking book is not just about financial riches; it’s about harnessing the incredible potential within you to create the life you desire. 1. The Mindset of Success “Think and Grow Rich” is a book that recognizes the importance of mindset in achieving success. Napoleon Hill explores the power of your thoughts and beliefs, emphasizing that success starts in the mind. By cultivating a positive and success-oriented mindset, you pave the way for prosperity and abundance in all areas of life. 2. The Principle of Desire Hill introduces the concept of a burning desire, an intense passion for your goals that propels you forward despite challenges. He explains how having a clear, defined goal combined with unwavering desire is the foundation for achieving greatness. The book guides you through the process of clarifying your desires and then channeling that energy into focused, persistent action. 3. The Power of Visualization Visualization is a key component of “Think and Grow Rich.” The book encourages you to vividly imagine your desired outcomes as if they have already been achieved. This powerful technique helps align your subconscious mind with your goals, making success more attainable. Visualization not only boosts your confidence but also attracts the opportunities and resources you need to manifest your dreams. 4. The Importance of Decision Decisiveness is a quality that separates the truly successful from those who remain stagnant. Hill stresses the significance of making firm decisions and taking decisive actions, even in the face of uncertainty. Hesitation and doubt can hinder progress, but by making clear decisions and committing to your goals, you create momentum and open the door to opportunities. 5. The Value of Persistence Success often requires resilience and persistence. “Think and Grow Rich” teaches you to persevere, even when faced with obstacles. The book shares inspiring stories of individuals who overcame significant challenges to achieve their goals. By embracing persistence and staying the course, you increase your chances of success and cultivate a mindset that can weather any storm. 6. The Mastermind Principle Napoleon Hill introduces the concept of the mastermind, a collaborative effort where like-minded individuals come together to support and empower each other. The mastermind principle amplifies creativity, knowledge, and motivation, leading to accelerated progress toward your goals. Conclusion “Think and Grow Rich” is not just a book; it’s a transformative guide that empowers you to unlock your full potential. By embracing the principles of mindset, desire, visualization, decision, persistence, and collaboration, you can shape your destiny and achieve the success you’ve always envisioned. Napoleon Hill’s timeless wisdom continues to inspire generations, reminding us that our thoughts, beliefs, and actions are the keys to creating the life of our dreams. Dive into the pages of this remarkable book, and embark on a journey of personal growth, wealth-building, and unlimited possibilities.

In today’s fast-paced world, achieving financial freedom can seem like an elusive dream, especially when burdened by debt. The weight of loans, credit card balances, and other financial obligations can hold you back from building wealth and living the life you truly desire. But fear not, for there are proven strategies that can help you break free from the shackles of debt and pave the way toward a future of financial abundance. In this blog, we’ll explore these strategies and provide actionable steps to guide you on your journey from debt to wealth. 1. Face Your Debt Head-On The first step on the path to financial freedom is to confront your debt. Ignoring it won’t make it disappear, and the stress it generates can hinder your overall well-being. Gather all your debt information, including the type of debt, interest rates, and minimum payments. Create a comprehensive overview of your financial situation. This clarity is essential as you develop a plan to tackle your debt. 2. Develop a Repayment Strategy Once you understand the scope of your debt, it’s time to create a repayment strategy. There are two popular methods you can consider: a. The Snowball Method: Pay off the smallest debts first while making minimum payments on the others. As each small debt is eliminated, you’ll gain momentum and motivation to tackle larger debts. b. The Avalanche Method: Prioritize debts with the highest interest rates. By eliminating high-interest debt, you’ll save more money in the long run. Choose the method that aligns with your financial situation and psychological mindset. 3. Create a Budget and Stick to It Budgeting is crucial for managing your finances and accelerating your journey to financial freedom. Track your income and expenses, identifying areas where you can cut back. Allocate a portion of your income to debt repayment while still setting aside funds for savings and investments. 4. Increase Your Income While reducing expenses is essential, increasing your income can significantly expedite your debt payoff and wealth-building process. Consider side hustles, freelancing, or exploring new career opportunities. Every extra dollar you earn can be directed toward your debt or invested to grow your wealth. 5. Build an Emergency Fund Financial emergencies can derail your progress. As you work on paying off debt, start building an emergency fund to cover unexpected expenses. Having this safety net will prevent you from falling back into the debt cycle when life throws curveballs. 6. Invest in Your Future Once you’ve paid off your debt, it’s time to shift your focus to wealth-building. Invest wisely in assets that appreciate over time, such as stocks, real estate, or retirement accounts. Educate yourself about investment options and consider seeking professional advice to make informed decisions. 7. Maintain Discipline and Patience Achieving financial freedom takes time and requires consistent effort. Stay disciplined, remain patient, and avoid unnecessary expenses that could set you back. Celebrate small victories along the way, and always keep your long-term goals in mind. Conclusion Breaking free from debt and building wealth is an empowering journey that requires dedication and a strategic approach. By facing your debt, creating a repayment plan, budgeting, increasing your income, building an emergency fund, and investing in your future, you can transform your financial situation from one of burden to one of abundance. Remember, with determination, discipline, and the right strategies, you can achieve the financial freedom you’ve always dreamed of. Start today, and take control of your financial destiny.

Introduction: Financial struggles can be incredibly challenging, and for Raj, the burden of loans and debts seemed insurmountable. With a debt exceeding 50,00,000 rupees and a monthly salary of 65,000 rupees, it appeared like an uphill battle. However, with careful planning, discipline, and a clear roadmap, it’s possible to climb out of this financial abyss. Let’s help Raj devise a plan to manage his finances, reduce debt, and create a brighter financial future. Step 1: Assess the Debt The first step in overcoming debt is to understand the full scope of the situation. Raj has loans and debts totaling over 50,00,000 rupees. He needs to make a list of all his debts, including the type of debt, interest rates, and minimum monthly payments. This clear picture will help in prioritizing which debts to tackle first. Step 2: Budgeting With a monthly salary of 65,000 rupees and expenses of 35,000 rupees, Raj has 30,000 rupees available for debt repayment and savings. However, this amount may vary depending on unexpected expenses, so it’s essential to create a comprehensive budget that accounts for all expenses, including necessities, utilities, groceries, transportation, and any other fixed or variable costs. Step 3: Prioritize Debts Not all debts are created equal. Some may have higher interest rates or more severe consequences if left unpaid. Raj should prioritize his debts based on these factors. High-interest loans (like credit card debt) should be tackled first, as the interest can compound rapidly. For other debts, he should try to negotiate with lenders for better terms if possible. Step 4: Debt Repayment Strategy Given Raj’s available monthly amount for debt repayment (30,000 rupees), he should allocate a significant portion of this towards the highest-priority debt. The remaining amount can be distributed among other debts, ensuring that he pays at least the minimum due on each. Once the highest-priority debt is paid off, he can reallocate the funds to the next debt on the list. Step 5: Lifestyle Adjustments While repaying debt, Raj might need to make some lifestyle adjustments. This could include cutting unnecessary expenses, finding ways to save on groceries or utilities, or even exploring opportunities to increase his income, like freelancing or part-time work. Step 6: Emergency Fund While focusing on debt repayment, Raj should also start building an emergency fund. Having a financial cushion can prevent future debt accumulation in case of unexpected expenses or emergencies. Step 7: Seek Professional Help If Raj’s debt situation is extremely complex or overwhelming, it might be wise to consult a financial advisor or debt counselor. These professionals can provide tailored advice and strategies based on his specific circumstances. Conclusion: Raj’s journey out of debt won’t be easy, but with determination and a well-structured plan, it’s entirely achievable. By following these steps and staying committed to his financial goals, he can gradually chip away at his debt, improve his credit, and pave the way for a more stable and prosperous future. Remember, the path to financial freedom is a marathon, not a sprint, and every step forward brings him closer to his goal.

Introduction The digital era has brought unparalleled convenience to our lives, including the ease of online shopping. However, this convenience can quickly turn into a financial burden when online overspending becomes a habit. The allure of endless choices, tempting deals, and one-click purchases can lead to impulsive spending that harms our financial health. In this blog post, we will explore practical strategies to help you regain control of your online spending habits and build a healthier relationship with your finances. Assess Your Financial Situation The first step towards controlling online overspending is to take a deep dive into your financial situation. Review your monthly income, fixed expenses, and discretionary spending. Use budgeting tools or apps to track your spending patterns. Understanding where your money goes will highlight potential areas of concern and pave the way for informed decisions. Set Realistic Financial Goals Setting clear financial goals is crucial for curbing overspending. Define both short-term and long-term objectives, such as saving for an emergency fund, a vacation, or paying off debts. Having specific goals will provide you with a sense of direction and purpose, making it easier to resist impulsive purchases. Create a Realistic Budget Once you have assessed your finances and set goals, create a realistic budget that aligns with your financial objectives. Allocate specific amounts for necessities, savings, and discretionary spending. Be honest with yourself about what you can afford, and make adjustments as needed to ensure you don’t exceed your budget. Minimize Temptations Online shopping platforms are designed to tempt and persuade you into buying more. Unsubscribe from promotional emails, turn off app notifications, and remove saved credit card information from your online accounts. By minimizing temptations, you can reduce the impulse to make unnecessary purchases. Implement the 24-Hour Rule Before making any non-essential online purchase, practice the 24-hour rule. Step away from the virtual shopping cart and wait for 24 hours. This cooling-off period allows you to evaluate if the purchase is truly necessary or if it’s driven by impulse. Often, you’ll find that the urge to buy subsides after some time. Use Cash or Debit Cards Using cash or debit cards for online transactions can be an effective strategy to control overspending. By limiting yourself to the amount available in your bank account, you avoid accumulating credit card debt and stay within your budget. Embrace Mindful Spending Mindfulness can be a powerful tool to combat online overspending. Be mindful of your emotional state when you’re considering a purchase. Are you feeling stressed, anxious, or bored? Acknowledge your emotions and find healthier alternatives to cope with them rather than resorting to retail therapy. Find Affordable Alternatives Explore alternative ways to enjoy your hobbies or interests without overspending. Look for free or low-cost activities, use public resources like libraries, or participate in local community events. By discovering affordable options, you can indulge in your passions without breaking the bank. Involve an Accountability Partner Share your financial goals with a close friend or family member who can act as your accountability partner. Regularly discuss your progress, challenges, and successes with them. Having someone to support and motivate you on your journey will increase your chances of success. Conclusion Controlling online overspending habits is a gradual process that requires discipline and commitment. By assessing your finances, setting realistic goals, creating a budget, and implementing strategies like the 24-hour rule and mindful spending, you can regain control of your finances and cultivate healthy spending habits. Remember, it’s about making conscious choices that align with your financial aspirations and priorities. Stay persistent, and celebrate your progress along the way. Your future self will thank you for taking charge of your financial well-being today.

Introduction: Welcome to our personal finance blog, where we’ll be exploring practical and proven strategies to help you take control of your finances and achieve long-term financial success. Whether you’re just starting your journey toward financial freedom or looking to optimize your current financial situation, this blog post will provide you with valuable insights and actionable tips to make informed decisions and build a secure future. Set Clear Financial Goals: The first step toward mastering your money is to establish clear financial goals. Ask yourself what you want to achieve in the short, medium, and long term. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having specific and achievable goals will keep you focused and motivated on your financial journey. Create a Budget: Creating a budget is the foundation of financial success. Track your income and expenses diligently to understand where your money is going. By identifying areas where you can cut back on unnecessary spending, you’ll have more money available for your goals. There are many budgeting tools and apps available to simplify the process and keep you on track. Eliminate Debt Strategically: Debt can be a significant obstacle to financial freedom. Develop a plan to pay off high-interest debts first, such as credit cards, while making minimum payments on other debts. Once you clear high-interest debt, redirect the money you were using to pay it off toward other debts or savings. Build an Emergency Fund: Life is full of unexpected events, and having an emergency fund is essential to avoid falling into debt during difficult times. Aim to save at least three to six months’ worth of living expenses in a separate savings account. This fund will act as a safety net during emergencies and give you peace of mind. Invest Wisely: Investing is a crucial aspect of building wealth. Diversify your investments across different asset classes, such as stocks, bonds, and real estate. Consider seeking advice from a financial advisor to ensure your investment strategy aligns with your risk tolerance and financial goals. Maximize Retirement Savings: Start contributing to retirement accounts early in your career, taking advantage of employer-sponsored plans like 401(k)s and individual retirement accounts (IRAs). The power of compounding can significantly boost your savings over time, allowing you to enjoy a comfortable retirement. Educate Yourself: Financial literacy is a valuable skill that can benefit you throughout your life. Continuously educate yourself about personal finance, investment strategies, and money management. Attend workshops, read books, and follow reputable financial experts to stay informed about the latest trends and opportunities. Conclusion: By following these proven strategies and incorporating them into your financial routine, you’ll be well on your way to mastering your money and achieving long-term financial success. Remember, the journey to financial freedom may have its challenges, but with dedication, discipline, and patience, you can take control of your finances and build a more secure and prosperous future for yourself and your loved ones. Stay tuned for more insightful content on personal finance to keep you motivated and informed throughout your financial journey.

Introduction Welcome to our blog on mindful spending and the art of aligning your financial decisions with your personal values and long-term goals. In today’s fast-paced world, it’s easy to get caught up in the cycle of mindless spending, leading to financial stress and dissatisfaction. However, by adopting a mindful approach to managing your money, you can gain control over your finances and create a more meaningful and fulfilling life. In this article, we’ll delve into the concept of mindful spending and provide you with some example calculations to help you make intentional choices that reflect your values and support your financial objectives. Understanding Mindful Spending Mindful spending involves being conscious of your financial choices and understanding how they align with your values and goals. Instead of making impulsive purchases or following societal pressures, you take a moment to consider whether a specific expense brings genuine value and happiness to your life. Example Calculation 1: The Daily Coffee Habit Let’s begin with a classic example: the daily coffee habit. Imagine you buy a $5 latte every workday. Here’s the calculation to assess its impact: Monthly coffee expenses: $5/day x 20 workdays = $100Annual coffee expenses: $100/month x 12 months = $1,200 Now, ask yourself: Does this daily coffee ritual genuinely align with your values and financial goals? If it brings you joy and enhances your well-being, it might be worth keeping. However, if you realize it’s more of a habit and doesn’t significantly contribute to your happiness, you could consider cutting back or finding a more budget-friendly alternative. Example Calculation 2: Subscription Services In today’s digital age, subscription services can quickly add up and become a financial drain. Let’s calculate the annual cost of some common subscriptions: Streaming Service A: $15/month x 12 months = $180Gym Membership: $30/month x 12 months = $360Magazine Subscription: $10/month x 12 months = $120 Total annual cost: $660 Review your subscriptions and consider whether they genuinely bring value to your life. If you find that you rarely use certain services or they don’t align with your interests and goals, canceling them could free up funds for more meaningful purposes. Example Calculation 3: Impulse Purchases vs. Savings Mindful spending involves resisting impulse purchases and directing that money toward savings and investments. Consider this scenario: Impulse Purchase: $50Potential Savings Contribution: $50 If you can reduce or eliminate impulse purchases and consistently redirect that money into savings or investments, it can significantly impact your long-term financial security and help you achieve your goals sooner. Conclusion Being mindful of your spending empowers you to make financial decisions that resonate with your values and support your aspirations. By calculating the costs of various expenses and comparing them with your priorities, you can identify areas where adjustments can be made. Remember, mindful spending doesn’t mean sacrificing all indulgences; rather, it’s about making intentional choices that align with what truly matters to you. Take control of your finances today, and pave the way for a more purposeful and financially secure future.

Introduction In today’s fast-paced world, managing personal finances is crucial for a stable and stress-free life. Meet Raj, a determined individual who has taken charge of his financial situation. With a monthly salary of 20,000₹, Raj found himself trapped in a cycle of unnecessary expenses and a burdensome EMI. However, he has decided to turn things around and steer his financial life towards the correct path. In this blog post, we will delve into Raj’s journey as he tackles his financial challenges head-on, eliminates unnecessary expenses, and strives for financial stability. Assessing the Current Situation: The first step Raj took was to evaluate his financial situation. He realized that a significant portion of his salary, 15,000₹, was going towards an EMI. This left him with a mere 5,000₹ to cover his day-to-day expenses. Recognizing the need for change, Raj knew that eliminating unnecessary expenses was crucial to achieving his financial goals. Identifying Unnecessary Expenses: Raj conducted a thorough analysis of his spending habits and identified areas where he could cut back. He scrutinized his monthly bills, subscriptions, and impulse purchases. By distinguishing between essential and non-essential expenses, Raj could prioritize his financial resources effectively. Creating a Budget: Equipped with a clear understanding of his expenses, Raj developed a comprehensive budget. He allocated a specific amount for essential expenses like groceries, rent, utilities, and transportation. By consciously setting aside funds for these necessities, Raj ensured that he wouldn’t overspend. Adopting Frugal Habits: Raj understood the importance of adopting frugal habits to maximize his savings. He started making small changes, such as cooking at home instead of eating out, brewing his own coffee, and using public transportation whenever possible. These simple adjustments helped him reduce expenses significantly, allowing him to allocate more funds towards savings and debt repayment. Seeking Professional Advice: Recognizing the need for expert guidance, Raj sought the assistance of a financial advisor. The advisor helped him develop a long-term financial plan, tailored to his specific goals and income. The advisor also provided valuable insights on investment options, savings strategies, and debt management, empowering Raj to make informed financial decisions. Tracking Progress and Staying Disciplined: Raj understood that consistent tracking of his progress was crucial to staying on the right financial path. He used budgeting apps and spreadsheets to monitor his expenses, savings, and debt repayment. Regularly reviewing his financial status allowed him to make necessary adjustments and maintain discipline. Let’s break down a sample calculation to illustrate Raj’s financial journey: To eliminate unnecessary expenses and allocate funds wisely, Raj created a budget: Total Essential Expenses: ₹10,000 Total Discretionary Expenses: ₹3,500 After deducting essential and discretionary expenses from the remaining monthly salary: Remaining Funds for Savings/Debt Repayment: ₹5,000 – ₹10,000 = -₹5,000 In this scenario, it seems that Raj’s expenses are exceeding his income, leading to a deficit of ₹5,000. To rectify this, Raj needs to revisit his budget and make adjustments to bring his expenses within his income. Possible Adjustments: By carefully analyzing his spending habits, making necessary adjustments, and seeking professional advice, Raj can bring his expenses in line with his income and work towards achieving financial stability. Remember, every individual’s financial situation is unique, so it’s essential to tailor the calculations and adjustments according to your specific circumstances. Conclusion: Raj’s journey towards financial stability showcases the transformative power of taking control of one’s finances. By eliminating unnecessary expenses, creating a budget, adopting frugal habits, seeking professional advice, and staying disciplined, Raj successfully changed the course of his financial life. He serves as an inspiration to anyone facing similar challenges, reminding us that it’s never too late to make positive changes and achieve financial well-being. Whether you’re starting with a modest income or struggling with debt, taking those first steps towards financial control can make a world of difference. Disclaimer: The above calculations are hypothetical and for illustrative purposes only. Actual expenses and income may vary based on individual circumstances. It is advisable to consult with a financial advisor or professional for personalized financial advice.

Introduction Personal finance is a lifelong journey that starts from the moment you start earning your own money. Whether you are just starting out in your career or getting ready to retire, there are certain financial milestones that you should strive to achieve at different ages. These milestones can help you stay on track with your financial goals and ensure that you are making progress towards building wealth and financial security. In Your 20s: Building a Strong Foundation Your 20s are a time of exploration and discovery, both in your personal and professional life. However, it’s also a crucial time for building a strong financial foundation. Here are some personal finance milestones to aim for in your 20s: Creating a Budget Creating a budget is the foundation of good personal finance. It can help you understand your income, expenses, and spending habits, and identify areas where you can cut back or save more. Building an Emergency Fund An emergency fund is a safety net that can help you cover unexpected expenses, such as car repairs or medical bills. Aim to save at least three to six months’ worth of living expenses in an emergency fund. Paying off Student Loans If you have student loans, aim to pay them off as soon as possible. Making extra payments or refinancing your loans can help you save on interest and pay off your debt faster. In Your 30s: Planning for the Future Your 30s are a time of stability and growth. You may have a family, a stable career, and more financial responsibilities. Here are some personal finance milestones to aim for in your 30s: Saving for Retirement Now is the time to start saving for retirement. Aim to save at least 15% of your income in a retirement account, such as a 401(k) or IRA. Buying a Home If you’re planning to buy a home, aim to save at least 20% for a down payment. This can help you avoid private mortgage insurance (PMI) and reduce your monthly mortgage payments. Investing in the Stock Market Investing in the stock market can help you build wealth over the long term. Consider investing in a low-cost index fund or exchange-traded fund (ETF) that tracks the performance of the overall stock market. In Your 40s: Nearing Retirement Your 40s are a time of transition as you near retirement. You may have more financial responsibilities, such as paying for your children’s college education. Here are some personal finance milestones to aim for in your 40s: Paying off Debt If you still have debt, aim to pay it off as soon as possible. This can help you reduce your monthly expenses and free up more money for savings. Saving for College If you have children, start saving for their college education. Consider opening a 529 plan, which offers tax-free growth and withdrawals for qualified education expenses. Reviewing Your Retirement Plan Review your retirement plan to ensure that you are on track to meet your goals. Consider increasing your contributions if you are behind on your savings. In Your 50s and Beyond: Retiring with Confidence Your 50s and beyond are a time of reflection and preparation for retirement. Here are some personal finance milestones to aim for as you near retirement: Catching Up on Retirement Savings If you’re behind on your retirement savings, now is the time to catch up. Consider making catch-up contributions to your retirement account, which allow you to save more if you’re over age 50. Creating a Retirement Budget Creating a retirement budget can help you understand your income and expenses in retirement. Consider working with

Introduction: Passive income ideas Passive income is a stream of income that requires little to no effort to maintain. It’s the dream of many people to earn money while they sleep or are on vacation. Fortunately, there are many passive income ideas out there that can help you achieve that dream. Investing in stocks and real estate One of the most popular ways to earn passive income is through investing in stocks and real estate. Both can offer regular dividends or rental income, respectively. However, investing does come with risks, and you should do your research and seek professional advice before jumping in. Create an online course or eBook Creating an online course or eBook can be a great way to earn passive income. Once you’ve created your content, you can sell it on platforms like Udemy, Coursera, or Amazon Kindle. The best part is that you can continue to earn money from your content long after you’ve finished creating it. Sell digital products If you have a talent for creating digital products like graphics, software, or even music, you can sell them on platforms like Etsy or Creative Market. This is a great way to earn passive income because once you’ve created the product, you can sell it over and over again. Create a YouTube channel or podcast Creating a YouTube channel or podcast can be a great way to earn passive income. Once you’ve built up a following, you can monetize your content with ads, sponsorships, and merchandise sales. Rent out your property on Airbnb If you have a spare room or a vacation home, you can rent it out on Airbnb. This is a great way to earn passive income because you don’t have to do much work besides cleaning and maintaining the property. Affiliate marketing Affiliate marketing is a type of marketing where you earn a commission for promoting other people’s products. You can do this through your blog, social media accounts, or YouTube channel. This can be a great way to earn passive income if you have a large following. Conclusion There are many passive income ideas out there, and these are just a few of them. Remember, passive income doesn’t mean no work at all, but rather it means that the work you put in upfront can continue to earn you money over time. So, start exploring these passive income ideas and find the ones that work best for you! Thanks for reading this “6 passive income ideas ” article, If you really loved it. please consider subscribing to Refill wealth