Tips for First-time Home Buyers First time Home Buyers can be both exciting and overwhelming. It’s a major financial investment and a decision that will impact your life for years to come. Whether you’re looking for a cozy starter home or a dream property, it’s essential to have a plan in place to make the process as smooth as possible. Here are 10 tips for first-time home buyers that can help you navigate the process with confidence. Establish Your BudgetBefore you begin house hunting, take the time to establish your budget. Determine how much you can comfortably afford to spend on a home by reviewing your income, expenses, and debt. You’ll also want to factor in other costs associated with homeownership, such as property taxes, insurance, and maintenance expenses. Get Pre-Approved for a MortgageGetting pre-approved for a mortgage is a crucial step in the home buying process. It will give you an idea of how much money you can borrow and help you understand what type of home you can afford. Plus, having a pre-approval letter will show sellers that you’re a serious buyer and give you an edge in a competitive market. Work with a Real Estate AgentWorking with a real estate agent can save you time and money in the home buying process. An agent can help you navigate the local market, find properties that meet your needs, and negotiate on your behalf. Plus, in most cases, the seller pays the agent’s commission, so there’s no cost to you. Look for the Right NeighborhoodWhen looking for a home, it’s essential to consider the neighborhood carefully. Look for a location that meets your needs in terms of proximity to work, schools, shopping, and other amenities. Research the crime rate and other statistics to ensure you’re choosing a safe and desirable area. Choose the Right PropertyOnce you’ve found the right neighborhood, it’s time to start looking for the right property. Work with your agent to create a list of must-haves and deal breakers. Look at properties online and attend open houses to get a sense of what’s available and what you can afford. Don’t Overlook Home InspectionsHome inspections are an essential part of the home buying process. They can identify potential problems with the property, such as structural issues, leaks, or mold. If an inspection reveals major issues, you may be able to negotiate repairs or a lower price. Be Prepared to NegotiateNegotiation is a crucial part of the home buying process. Be prepared to negotiate with the seller, particularly if there are issues with the property or you’re in a competitive market. Your agent can help you understand what’s reasonable and negotiate on your behalf. Don’t Forget About Closing CostsClosing costs are the fees associated with finalizing the purchase of a home. They can include appraisal fees, title insurance, and attorney fees, among others. Make sure you budget for these costs, which can range from 2-5% of the purchase price of the home. Take Advantage of First-Time Home Buyers ProgramsMany states and municipalities offer first-time home buyers programs that can help make homeownership more affordable. These programs can provide down payment assistance, tax credits, and other incentives to help you buy your first home. Stay PatientHome Buyers can take time, so it’s essential to stay patient throughout the process. Be prepared for the unexpected, such as a bidding war or a delay in closing. Remember that finding the right home can take time, but it’s worth the wait to find a property that meets your needs and fits your budget. In conclusion, Home Buyers can be a rewarding experience, but it’s essential to approach it with a plan in place. Establishing your budget, getting pre Establishing Your Budget: Understanding the Financial Aspects of Homeownership Establishing your budget is a crucial first step when it comes to buying your first home. It’s important to have a clear understanding of the financial aspects of homeownership to ensure that you can afford the property you’re interested in and that you’re prepared for the costs associated with owning a home. Here are some tips to help you establish your budget and navigate the financial aspects of homeownership: Calculate Your Income and ExpensesThe first step in establishing your budget is to calculate your monthly income and expenses. This will give you a clear picture of your financial situation and help you determine how much you can afford to spend on a home. Be sure to include all sources of income, such as your salary, bonuses, and any other sources of income you may have. You should also include all of your monthly expenses, including rent, utilities, transportation costs, food, and any other bills you may have. Determine Your Debt-to-Income RatioYour debt-to-income ratio is an important factor that lenders consider when determining your eligibility for a mortgage. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. Ideally, your debt-to-income ratio should be below 43% to qualify for a conventional mortgage. If your ratio is higher, you may need to consider other options or work on paying down your debt before you can qualify for a mortgage. Consider Your Down PaymentYour down payment is another crucial factor to consider when establishing your budget. Most lenders require a down payment of at least 5% to 20% of the home’s purchase price. The larger your down payment, the lower your monthly mortgage payments will be. Keep in mind that you’ll also need to budget for other closing costs, such as appraisal fees, title insurance, and attorney fees. Factor in Property Taxes and Homeowners InsuranceIn addition to your monthly mortgage payments, you’ll also need to budget for property taxes and homeowners insurance. Property taxes can vary depending on where you live, so be sure to research the tax rates in the areas you’re interested in. Homeowners insurance is also an essential expense that will protect your investment in case of damage or loss. Plan for Home Maintenance and RepairsOwning a home

Common investment mistakes Lack of Diversification: Understanding the Importance of Asset Allocation Investing is a great way to grow your wealth over time, but it is important to approach it in a strategic way to avoid common investment mistakes. One of the most Common investment mistakes that investors make is failing to diversify their investments properly. Diversification is an investment strategy that involves investing in a variety of different assets to minimize risk and maximize returns. A key component of diversification is asset allocation, which is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. In this blog, we will focus on the importance of asset allocation and the benefits of a well-diversified portfolio. What is Asset Allocation? Asset allocation is the process of dividing your investment portfolio among different asset classes to achieve a specific risk and return objective. The three primary asset classes are stocks, bonds, and cash. Stocks are considered higher-risk investments because they are subject to greater volatility than other asset classes. Bonds are typically lower-risk investments that offer lower returns than stocks. Cash, meanwhile, is the lowest-risk asset class but also offers the lowest potential returns. Why is Asset Allocation Important? Asset allocation is important because it can help minimize risk and maximize returns. By diversifying your investments across different asset classes, you can reduce the impact of market volatility on your portfolio. For example, if the stock market experiences a downturn, a portfolio that is heavily invested in stocks will be more negatively affected than a portfolio that is diversified across stocks, bonds, and cash. In addition to reducing risk, asset allocation can also help you maximize returns over the long term. Different asset classes tend to perform differently over time, and by investing in a variety of assets, you can take advantage of these variations to achieve a balanced and diversified portfolio. For example, while stocks may perform well in a booming economy, bonds may perform better in a recession. A well-diversified portfolio that includes both asset classes can help you weather market fluctuations and achieve stable returns over time. How to Implement Asset Allocation Implementing asset allocation requires careful planning and analysis of your investment goals and risk tolerance. To begin, consider your investment goals and how long you plan to hold your investments. If you are investing for the long-term, you may be able to take on more risk in your portfolio. On the other hand, if you are investing for the short-term, you may want to focus on lower-risk investments to protect your capital. Once you have determined your investment goals and risk tolerance, you can begin building a diversified portfolio by investing in a variety of different asset classes. For example, you may choose to invest in a mix of stocks, bonds, and cash, with a higher percentage of stocks for long-term growth and a higher percentage of bonds and cash for stability and income. Emotional Investing: How to Keep Your Cool in Volatile Markets Investing can be a rollercoaster ride, with market volatility and unpredictable events causing emotional highs and lows. However, letting emotions dictate investment decisions can be a recipe for disaster. Emotional investing, or making decisions based on fear, greed, or panic, can lead to impulsive decisions that harm investment returns over the long-term. In this blog, we will discuss how to keep your cool in volatile markets and avoid the pitfalls of emotional investing. Understanding the Impact of Emotions on Investment Decisions Before we dive into how to keep emotions in check, it is important to understand why emotional investing can be detrimental to investment returns. When we make investment decisions based on emotions, we are more likely to buy and sell assets at the wrong times. For example, if you panic and sell all of your stocks during a market downturn, you may miss out on potential gains when the market rebounds. On the other hand, if you get caught up in a market frenzy and invest heavily in a hot stock, you may be setting yourself up for losses when the bubble bursts. Steps to Keep Emotions in Check Stick to a Plan: Having a well-defined investment plan can help you stay focused on your long-term goals and avoid impulsive decisions. Your plan should include your investment goals, risk tolerance, and a diversified portfolio that matches your objectives. Ignore the Noise: News headlines and social media can be filled with hype and sensationalism that can trigger emotional responses. Instead of getting caught up in the noise, focus on your investment plan and trusted sources of information. Stay Disciplined: Market volatility is a fact of investing, and it can be tempting to make changes to your portfolio in response to every bump in the road. Sticking to your investment plan and avoiding impulsive decisions can help you avoid costly Common investment mistakes. Keep a Long-Term Perspective: Investing is a long-term game, and short-term market fluctuations should not deter you from your long-term goals. Keeping a long-term perspective can help you ride out market volatility and benefit from the power of compounding over time. Seek Professional Advice: If you are struggling to manage your emotions and investment decisions, consider seeking the advice of a professional financial advisor. A good advisor can help you stay focused on your goals and avoid costly emotional mistakes. Market Timing: Why it rarely works and what to do instead When it comes to investing, everyone wants to buy low and sell high. It’s a simple concept, but putting it into practice is not so easy. Many investors try to time the market, hoping to make big profits by buying and selling at just the right time. Unfortunately, market timing rarely works and can actually hurt your portfolio in the long run. In this blog post, we will explore why market timing is a flawed strategy and provide some alternatives that can help you achieve your investment goals. The Myth of Market

Save Money on Groceries Grocery shopping is a necessary task that everyone has to do. However, it can be expensive if you don’t plan ahead. With the rising cost of food, save money on groceries has become more important than ever. Here are 21 tips and tricks to help you save money on groceries: Making Small Changes for Big Savings on Groceries Grocery shopping is a necessary expense, but it can be expensive if you’re not careful. With the rising cost of food, it’s important to find ways to save money on your grocery bill. Making small changes to your shopping habits can add up to big savings over time. Here are some tips for making small changes for big savings on groceries: Buy store brands One small change you can make is to buy store brands instead of name brands. Store brands are often just as good as name brands, but they’re typically cheaper. They may even be made by the same manufacturer as the name brand, but with a different label. So next time you’re shopping, compare the price of the name brand to the store brand and see how much you can save. Cut back on meat Meat is often the most expensive item on your grocery list. You don’t have to become a vegetarian to save money on groceries, but you can cut back on meat to save money. Consider having meatless meals once or twice a week, or using meat as a flavoring instead of the main ingredient. For example, use half the amount of meat in a recipe and replace it with beans or vegetables. Buy in bulk Another way to save money on groceries is to buy in bulk. Buying in bulk can save you money in the long run, especially if it’s a product you use frequently. Look for deals on family-sized packs of meat, or buy dry goods like rice, pasta, and cereal in bulk. Just make sure you have enough storage space to store your bulk purchases. Plan your meals Planning your meals can help you save money on groceries. When you plan your meals, you know exactly what you need to buy at the store. This means you can avoid buying items you don’t need, which can save you money. Planning your meals also helps you avoid eating out, which can be expensive. Use cashback apps Cashback apps like Ibotta and Checkout 51 can help you save money on groceries. These apps offer cashback on certain products when you buy them at the store. All you have to do is scan your receipt and the app will give you cashback on qualifying purchases. Over time, these savings can add up. In conclusion, making small changes to your shopping habits can add up to big savings on groceries. By buying store brands, cutting back on meat, buying in bulk, planning your meals, and using cashback apps, you can save money on your grocery bill. Start making these small changes today and watch your savings grow over time. In conclusion, there are many ways to save money on groceries. By planning ahead, shopping smart, and making small changes, you can reduce your grocery bill and save money in the long run. Thanks for reading this article ” How to Save Money on Groceries” If you really liked this article. Consider subscribing

Summary Here are 5 key takeaways from the blog on how to save money when buying a home: “To buy a nice home is to buy a better way of life. To choose a better way of life is to work toward well-being, and isn’t well-being what’s paramount?” Are you planning to buy a new home? Congratulations! Owning a home is a dream come true for many. But, it is also one of the most significant investments you will make in your life. Buying a home can be expensive, but there are ways to save money. In this blog post, we will discuss how to save money when buying a home. Set a budget and stick to it Before you start looking for a home, it is important to set a budget. Figure out how much you can afford to spend on a home, taking into consideration your income, expenses, and savings. Once you have a budget, stick to it. Don’t be tempted to overspend, as it can lead to financial problems in the future. Shop around for a mortgage Mortgage rates can vary significantly from one lender to another. Therefore, it is important to shop around for a mortgage. Compare rates from different lenders and choose the one that offers the best deal. A lower interest rate can save you thousands of dollars over the life of your loan. Consider a smaller home and save money Buying a smaller home can save you money in several ways. Firstly, the purchase price will be lower, which means a smaller mortgage and lower monthly payments. Secondly, a smaller home will have lower utility bills and maintenance costs. Lastly, a smaller home will be easier to furnish and decorate, which can save you money on furniture and accessories. Look for homes that need some work Homes that need some work can be a good investment. Look for homes that need cosmetic updates, such as paint, flooring, or landscaping. These updates can be done over time, allowing you to spread out the cost. Additionally, homes that need some work are often priced lower than move-in ready homes, which can save you money. Negotiate the price Don’t be afraid to negotiate the price of a home. The asking price is just that – an asking price. You may be able to negotiate a lower price, particularly if the home has been on the market for a while. Additionally, if you are buying in a buyer’s market, you may have more negotiating power. Get a home inspection A home inspection can reveal any issues with a home before you buy it. If the inspection uncovers any issues, you may be able to negotiate a lower price or ask the seller to make repairs. This can save you money in the long run, as you won’t have to pay for expensive repairs down the line. Choose the right time when buying a home The real estate market can be cyclical, with highs and lows. Choosing the right time to buy can save you money. For example, buying in a buyer’s market can give you more negotiating power, while buying in a seller’s market may result in higher prices. In conclusion, buying a home can be expensive, but there are ways to save money. Set a budget and stick to it, shop around for a mortgage, consider a smaller home, look for homes that need some work, negotiate the price, get a home inspection, and choose the right time to buy. By following these tips, you can save money when buying a home and enjoy the benefits of homeownership without breaking the bank.

Are you looking to Sell your skills to Make money from the comfort of your own home? Selling your skills online can be a great way to do so. With the rise of the gig economy and the proliferation of online platforms, it’s never been easier to monetize your talents and expertise. In this step-by-step guide, we’ll walk you through the process of selling your skills online and making money. Perhaps it’s time to turn your focus inward and start investing in yourself. Upgrading your skills and knowledge can lead to a more fulfilling career, and ultimately, financial success. Here’s why investing in yourself is the best investment you can make: Your Skills are Your Greatest Asset In today’s ever-changing job market, your skills are your most valuable asset. Investing in your skills and upgrading your knowledge can lead to greater opportunities for career advancement and financial gain. By focusing on your own personal and professional development, you can increase your earning potential and position yourself for long-term success. You Control Your Own Destiny Investing in yourself means taking control of your own future. By continuously learning and growing, you become less dependent on external factors like the stock market or the economy. You can create your own opportunities and take your career in the direction you want it to go. The Benefits are Long-Term Investing in yourself pays dividends for years to come. The skills and knowledge you acquire stay with you for life, and can help you navigate the ever-changing job market. Plus, upgrading your skills can increase your confidence, boost your creativity, and improve your overall quality of life. It’s More Reliable Than the Stock Market As you mentioned in your input, financial predictions in the stock market can be unreliable. Investing in yourself is a more reliable way to achieve financial success. By improving your skills and knowledge, you increase your value in the job market and make yourself more employable. You don’t have to worry about market fluctuations or external factors that are out of your control. How to sell your skills online & Make money Step 1: Identify and Sell Your Skills Online The first step is to identify and sell your skills online. Do you have expertise in graphic design, writing, programming, social media marketing, or some other field? Once you know what skills you have to offer, you can start looking for platforms that match your skills with potential clients. Step 2: Choose the right platform to Sell Your Skills Online There are a variety of online platforms that allow you to sell your skills, such as Upwork, Fiverr, and Freelancer.com. Each platform has its own strengths and weaknesses, so it’s important to do your research and choose the one that best fits your skills and needs. Consider factors like fees, competition, and the types of clients who use the platform. Top 10 Online platforms to Sell Your Skills Online Here are 10 online platforms where you can Sell Your Skills online: Upwork: Upwork is a freelance marketplace where businesses and individuals can hire freelancers for a wide range of projects, from web development and graphic design to writing and virtual assistant work. Fiverr: Fiverr is a platform that connects freelancers with businesses and individuals in need of various services, including graphic design, video production, and copywriting. Etsy: Etsy is an e-commerce platform that enables artisans and craftspeople to sell their handmade or vintage goods directly to buyers around the world. Airbnb: Airbnb is a popular online marketplace where people can rent out their homes or apartments to travelers looking for short-term lodging. YouTube: YouTube is a video-sharing platform where content creators can earn money through ads, sponsorships, and other revenue streams. Amazon Mechanical Turk: Amazon Mechanical Turk is a crowdsourcing platform where businesses can outsource simple, repetitive tasks to a global workforce. Udemy: Udemy is an online learning platform that allows instructors to create and sell courses on a wide range of topics, from business and technology to health and fitness. Shutterstock: Shutterstock is a stock photography and video marketplace where photographers and videographers can upload their content and earn money through licensing and downloads. Rover: Rover is a platform that connects pet owners with pet sitters and dog walkers, enabling people to earn money by providing pet care services. TaskRabbit: TaskRabbit is a platform that connects people in need of various services, such as home cleaning, handyman work, and errand running, with skilled taskers who can provide those services for a fee. Top 10 Offline platforms to Sell Your Skills Online Babysitting: Babysitting is a popular way to Sell Your Skills Online by watching children for parents who need to work or go out for the evening. Dog walking and pet sitting: Similar to babysitting, dog walking and pet sitting are in-demand services that can help you earn money by taking care of pets while their owners are away. Lawn care and landscaping: If you enjoy working outdoors, you can offer your services for lawn care and landscaping to homeowners in your local community. Freelance photography: If you have a talent for photography, you can offer your services for events like weddings, parties, and portraits. Home cleaning: Many people are willing to pay for help with cleaning their homes, so offering home cleaning services can be a lucrative opportunity. Personal shopping and styling: If you have a knack for fashion and shopping, you can offer personal shopping and styling services to people who want help with their wardrobe. Handyman services: If you are skilled at fixing things around the house, you can offer handyman services to homeowners in your community. Personal training: If you are passionate about fitness and exercise, you can offer personal training services to people who want to get in shape and stay healthy. Music lessons: If you are skilled at playing an instrument, you can offer music lessons to people who want to learn how to play. Tutoring: If you are knowledgeable in a particular

Photo by Sasun Bughdaryan on Unsplash Are you tired of feeling like you’re always living paycheck to paycheck? Do you struggle to How to save money every month? If so, you’re not alone. Many people struggle with the same issue. Fortunately, there are steps you can take to save money and improve your financial situation. Start with an Example Now we can see a real-time example to save your money every month, Do you like coffee? One practical example of how to save money is by cutting back on your daily coffee habit. If you’re used to buying a $4 coffee every day, that adds up to $120 per month. Instead, consider brewing your own coffee at home or at work. Invest in a good quality coffee maker and buy your favorite coffee beans in bulk. This way, you can still enjoy your morning cup of joe without spending a lot of money. Over the course of a year, this small change could save you up to $1,440! Another practical example of how to save money is by buying generic or store-brand products instead of name-brand products. Often, the generic or store-brand products are just as good as the name-brand products, but at a much lower cost. You can save money on groceries, cleaning products, and other household items by choosing the generic or store-brand option. Over time, these small savings can add up to a significant amount of money. Okay, Let’s get into this blog post, we’ll cover some practical tips on how to save money every month. Create a budget The first step to saving money is creating a budget. This will help you understand where your money is going each month and identify areas where you can cut back. Start by listing all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Then, compare your total expenses to your income. If you’re spending more than you’re earning, you’ll need to make some adjustments. Use Spreadsheets or Budgeting application creating a budget done by using a spreadsheet or budgeting app. Start by listing all of your monthly income sources, such as your salary, freelance work, or any other sources of income. Then, list all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Assign a dollar amount to each expense category and subtract the total expenses from the total income to see if you have a surplus or deficit. This will give you a clear picture of where your money is going each month and where you may need to adjust your spending. You can also use a budgeting app like Mint or YNAB to automatically track your spending and categorize your expenses. This way, you can easily see how much you’re spending in each category and identify areas where you can cut back. Cut back on unnecessary expenses Once you’ve created a budget, look for ways to cut back on unnecessary expenses. For example, do you really need that gym membership you never use? Or, could you save money by cooking at home instead of eating out? Look for small changes you can make that will add up over time. Set financial goals & save money Setting financial goals is a great way to stay motivated and on track. Start by setting a savings goal for each month. This could be as simple as saving $50 or $100. As you become more comfortable with saving, you can increase your goals. One practical example of setting financial goals is creating an emergency fund. This fund can be used to cover unexpected expenses, such as car repairs or medical bills, without having to rely on credit cards or loans. Start by setting a goal to save a certain amount, such as $1,000 or $2,000, and then make a plan to reach that goal. You can set up automatic transfers from your checking account to your emergency fund each month, or allocate a portion of your tax refund or bonus to the fund. By setting this financial goal and making a plan to achieve it, you’ll be prepared for unexpected expenses and avoid going into debt. Use apps and tools to help you save money There are many apps and tools available that can help you save money. For example, some apps will automatically save small amounts of money from your checking account each week. Others will help you find coupons and deals to save money on your purchases. I will Suggest Wallet & Bluecoins Mobile applications to track your money. I’m using these two tools for the past two years. It’s amazing. Pay yourself first One of the most effective ways to save money is to pay yourself first. This means setting aside a portion of your income for savings before you pay your bills or spend money on anything else. Even if it’s just a small amount, paying yourself first will help you develop the habit of saving. Conclusion: How to save money every month Expense Category Monthly Expense Money-Saving Strategies Housing $1,200 (rent) Consider downsizing to a smaller apartment or finding a roommate to split rent costs. Utilities $150 Turn off lights and electronics when not in use, adjust thermostat by a few degrees, switch to energy-efficient light bulbs. Transportation $200 Carpool to work, walk or bike instead of driving short distances, use public transportation. Food $500 Plan meals in advance and make a grocery list, cook at home instead of eating out, buy generic or store-brand products. Entertainment $100 Look for free or low-cost activities, such as hiking or visiting museums, instead of expensive outings. Total Monthly Expenses $2,150 Money-Saving Goal: Reduce monthly expenses by 10% by cutting back on unnecessary expenses and finding ways to save money. Sample Monthly Budgeting By identifying your monthly expenses and finding ways to reduce them, you can set a goal to save a certain percentage each month. In this example, the goal is to reduce monthly expenses by 10% and

In today’s world, it’s important to take control of your finances and create a budget that works for you and your lifestyle. Budgeting can help you maximize your income, save money, and achieve your financial goals. However, creating a budget can seem daunting, especially if you’re not sure where to start. In this blog post, we’ll discuss how to create a budget that works for you and your lifestyle. Step 1: Calculate Your Income The first step in creating a budget is to calculate your income. This includes your salary, bonuses, and any other sources of income. It’s important to be accurate when calculating your income, as this will help you determine how much you can afford to spend and save each month. Step 2: Track Your Expenses The next step is to track your expenses. This includes everything from rent and utilities to groceries and entertainment. You can use a spreadsheet or budgeting app to track your expenses, or simply write them down on a piece of paper. The key is to be as detailed as possible and to include all of your expenses. Step 3: Categorize Your Expenses Once you’ve tracked your expenses, it’s time to categorize them. This will help you see where your money is going and where you can cut back. Common expense categories include housing, transportation, food, entertainment, and debt payments. Step 4: Set Goals Now that you know how much you’re earning and spending, it’s time to set some financial goals. These goals can include things like paying off debt, saving for a down payment on a house, or investing for retirement. It’s important to set realistic goals that you can achieve within a reasonable timeframe. Step 5: Create a Budget With all of this information in hand, it’s time to create a budget. Start by listing your income at the top of the page, then subtract your expenses. If you have money left over, this is your disposable income. If you’re in the red, it’s time to look for ways to cut back on expenses or increase your income. Step 6: Monitor Your Budget Creating a budget is just the first step. You also need to monitor your budget regularly to ensure you’re staying on track. This means tracking your expenses and income each month and making adjustments as needed. You may also want to set up alerts or reminders to help you stay on top of your budget. Maximizing your income is all about taking control of your finances and creating a budget that works for you and your lifestyle. By following these steps, you can create a budget that will help you achieve your financial goals and live the life you want. Remember, budgeting is a process, so don’t be afraid to make adjustments and try new things until you find a budget that works for you.

Image by freepik Money management is a crucial skill that young adults must develop as they transition into independence. Whether it’s paying bills, saving for the future, or investing in assets, having a solid grasp of financial literacy is essential. Unfortunately, many young adults struggle with managing their finances, leading to debt and financial instability. To help you avoid these pitfalls, we’ve compiled a list of ten essential money management rules for young adults. Create a budget: Creating a budget is the foundation of sound money management. Start by listing all of your sources of income and all of your expenses, including rent, bills, groceries, and discretionary spending. Then, track your spending to ensure that you’re sticking to your budget. Live within your means: Avoid the temptation to overspend by living within your means. This means not buying things you can’t afford and not relying on credit cards to fund your lifestyle. Instead, prioritize your expenses and focus on what you need rather than what you want. Set financial goals: Setting financial goals can help you stay motivated and on track. Whether it’s saving for a down payment on a house or paying off student loans, having a clear goal in mind will make it easier to stick to your budget. Start an emergency fund: Unexpected expenses can quickly derail your financial stability. That’s why it’s essential to start an emergency fund that can cover at least three to six months of living expenses. Put aside a small portion of your income each month into a separate savings account to build up your emergency fund. Pay off high-interest debt: High-interest debt, such as credit card balances, can quickly accumulate and become unmanageable. Focus on paying off high-interest debt first to reduce the amount of interest you’re paying and improve your credit score. Avoid unnecessary expenses: It’s easy to get caught up in the latest trends and fads, but avoid unnecessary expenses that don’t add value to your life. Instead, focus on experiences and activities that bring you joy and fulfillment without breaking the bank. Invest in your future: Investing in your future is crucial to long-term financial stability. Whether it’s investing in your education, retirement, or real estate, make sure you’re putting money aside for your future. Track your credit score: Your credit score is a crucial factor in your financial health. It affects your ability to borrow money, obtain credit cards, and even rent an apartment. Use credit monitoring tools to track your credit score and take steps to improve it if necessary. Negotiate bills and expenses: Don’t be afraid to negotiate bills and expenses to save money. You can often negotiate lower rates on bills such as cable and internet, and even negotiate your salary at work. Learn from your mistakes: Finally, don’t beat yourself up if you make financial mistakes. Instead, use them as learning opportunities to improve your money management skills and avoid making the same mistakes in the future. In conclusion, managing your finances as a young adult is crucial to your long-term financial health. By following these ten essential money management rules, you’ll be well on your way to financial stability and success. Remember, it’s never too early to start building good money management habits.

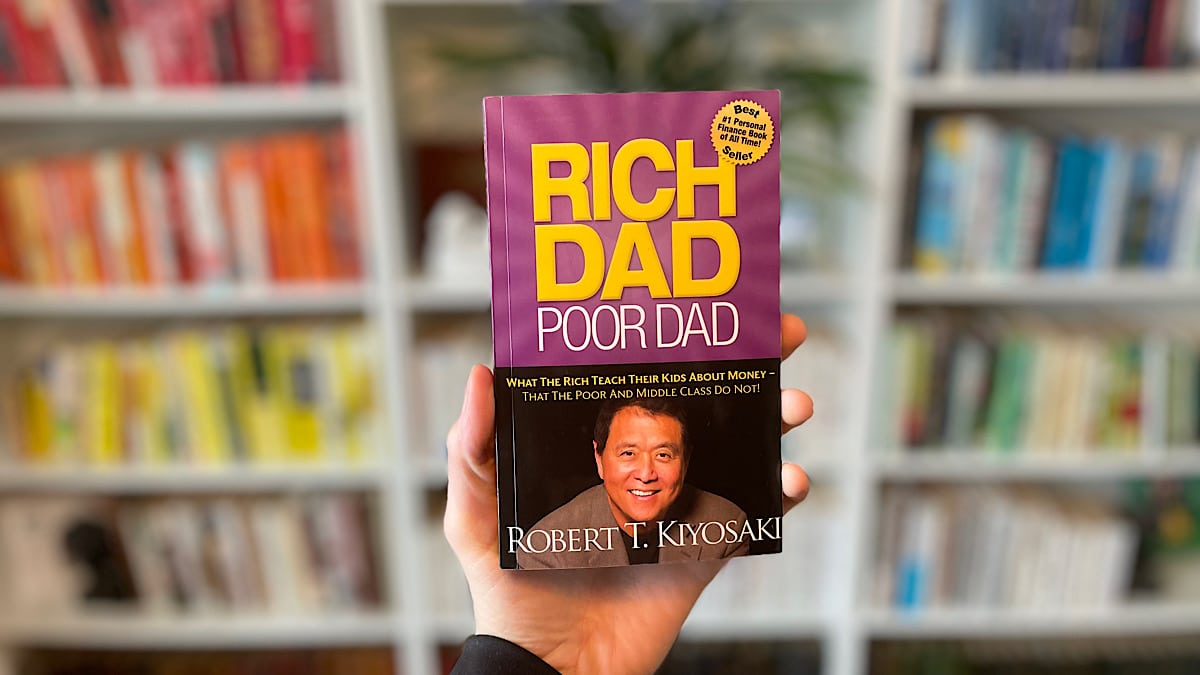

“Rich Dad Poor Dad” is a book written by Robert Kiyosaki that has had a significant impact on personal finance and wealth creation. Published in 1997, it has sold over 32 million copies in over 40 languages worldwide, making it one of the most popular personal finance books ever written. This book is written in a storytelling format and is based on Kiyosaki’s personal experiences with his own “rich dad” and “poor dad.” The main premise of the book is that financial education is not taught in schools, and many people are not equipped with the knowledge and skills to manage their finances effectively. The book offers a different perspective on money and wealth, challenging traditional beliefs about work, saving, and investing. In the book, Kiyosaki shares two contrasting stories of his two fathers – his biological father, who he refers to as the “poor dad,” and his friend’s father, who he calls the “rich dad.” He uses their stories to illustrate different approaches to money management and financial education. Kiyosaki’s poor dad was a highly educated man who worked hard and had a good job but struggled financially. He believed in getting a good education, getting a stable job, and saving money for retirement. His rich dad, on the other hand, was a self-made millionaire who had built his wealth through entrepreneurship and investing. One of the key takeaways from the book is the importance of financial literacy. Kiyosaki argues that financial literacy is not just about knowing how to budget and save money, but also about understanding the difference between assets and liabilities, understanding taxes, and understanding how to use leverage to build wealth. Kiyosaki also highlights the importance of investing in assets that generate income, such as real estate or stocks, rather than just saving money in a bank account. He emphasizes the value of taking calculated risks and stepping outside of one’s comfort zone to create wealth. Another important message from the book is the concept of “paying yourself first.” Kiyosaki argues that people should prioritize investing in themselves and their financial future by setting aside a portion of their income for investing, rather than just living paycheck to paycheck. The book also challenges the traditional idea of job security and encourages readers to explore entrepreneurship and creating their own businesses. Kiyosaki argues that relying solely on a job for income is risky, and that building one’s own business can provide more financial freedom and stability. Overall, “Rich Dad Poor Dad” offers a fresh perspective on personal finance and wealth creation, challenging traditional beliefs and offering practical advice for building wealth. The book emphasizes the importance of financial education, investing in assets that generate income, and taking calculated risks to achieve financial freedom.

Many people dream of becoming a crorepati, which means having a net worth of 1 crore rupees or more. However, the path to achieving this goal can seem daunting, especially for those with a modest salary. Can you reach the 1 crore milestone with a salary of just 20,000 rupees per month? The answer is yes, but it will require careful planning, disciplined saving, and smart investing. Here are some steps you can take to reach the 1 crore milestone with a 20,000 salary: Set a goal and create a plan: The first step towards achieving any financial goal is to set a specific target and create a plan to achieve it. Determine how much you need to save each month, how long it will take to reach your goal, and what steps you need to take to get there. Cut expenses and save aggressively: To reach the 1 crore milestone, you will need to save aggressively. This means cutting back on unnecessary expenses and putting as much money as possible towards your savings. Consider ways to reduce your rent, utilities, transportation, and food costs to free up more money for saving and investing. Invest in the stock market: Investing in the stock market is one of the most effective ways to grow your wealth over the long term. Even with a small salary, you can start investing in stocks through mutual funds, which allow you to pool your money with other investors to buy a diversified portfolio of stocks. Over time, the compounding effect of your investments can help you achieve your financial goals. Consider other investment options: In addition to stocks, there are other investment options that can help you grow your wealth, such as fixed deposits, real estate, and gold. Research these options and consider which ones are best suited to your financial goals and risk tolerance. Be disciplined and patient: Reaching the 1 crore milestone with a 20,000 salary will require discipline and patience. It may take years or even decades to reach your goal, but if you stay focused and committed, you can get there. In summary, reaching the 1 crore milestone with a 20,000 salary is possible, but it will require careful planning, disciplined saving, and smart investing. By setting a specific goal, cutting expenses, investing in the stock market, considering other investment options, and staying disciplined and patient, you can achieve your financial dreams.