In a world where financial success often appears elusive, a stark contrast emerges between those effortlessly ascending the economic ladder and those grappling to make ends meet. The pursuit of true wealth is more than a mere aspiration; it is a journey laden with challenges, choices, and transformative moments. Have you ever pondered why some individuals seemingly navigate this journey effortlessly, while others find themselves caught in the throes of financial uncertainty? This comprehensive exploration delves into the intricacies of the path to financial triumph, dissecting key factors that may hinder progress and illuminating strategies to overcome these barriers. From challenging the conventional 9-5 mindset to embracing failure as a stepping stone, we embark on a journey of self-discovery and empowerment, aiming to equip individuals with the knowledge and mindset necessary to break free from common constraints and achieve lasting financial success. Join me as we unravel the mysteries of wealth creation and navigate the intricate terrain of financial empowerment. Section 1: Breaking Free from the 9-5 Mindset Section 2: Choosing Your Own Path Section 3: Embracing Failure as a Stepping Stone Section 4: Surrounding Yourself with Success Section 5: Earning vs. Saving Section 6: Demystifying Luck Section 7: Investing Wisely Section 8: Setting Financial Goals Section 9: Living Within Your Means Section 10: Owning Your Choices Section 11: Embracing Lifelong Learning Section 12: Cultivating Self-Discipline Conclusion: In concluding our expedition through the labyrinth of financial success, we find ourselves standing at the intersection of empowerment and opportunity. The key lessons we’ve unearthed – from challenging the 9-5 paradigm to embracing failure, making strategic choices, and fostering discipline – collectively form a blueprint for transcending the common barriers to wealth. As we reflect on the transformative insights shared, the journey becomes more than a pursuit of monetary gain; it is a profound exploration of self-discovery and empowerment. It is a testament to the potential within each individual to sculpt their financial destiny consciously. Armed with the understanding that success is not a stroke of luck but a result of intentional choices and actions, we emerge ready to chart our course with resilience, wisdom, and an unwavering commitment to our financial goals. The call-to-action resounds: let us empower ourselves, embrace change, learn continuously, and embark on decisive actions to claim our seat at the table of financial success. The path may be challenging, but the destination is worth the journey. Here’s to a future adorned with prosperity, resilience, and the enduring glow of achieved financial goals.

Introduction: In a world full of opportunities, there are countless ways to earn money beyond the traditional 9-to-5 job. Whether you’re looking to supplement your income, explore a passion, or embark on a new entrepreneurial journey, this blog unveils 100 creative and diverse ways to put extra cash in your pocket. From the conventional to the unconventional, let’s dive into a world of possibilities Conclusion: The possibilities for earning money are endless, and this list is just the tip of the iceberg. Finding the right avenue for you depends on your skills, interests, and the amount of effort you’re willing to invest. Whether you choose a traditional job, an online venture, or a creative pursuit, the key is to stay motivated and embrace the diverse opportunities available in today’s dynamic economy. Happy earning!

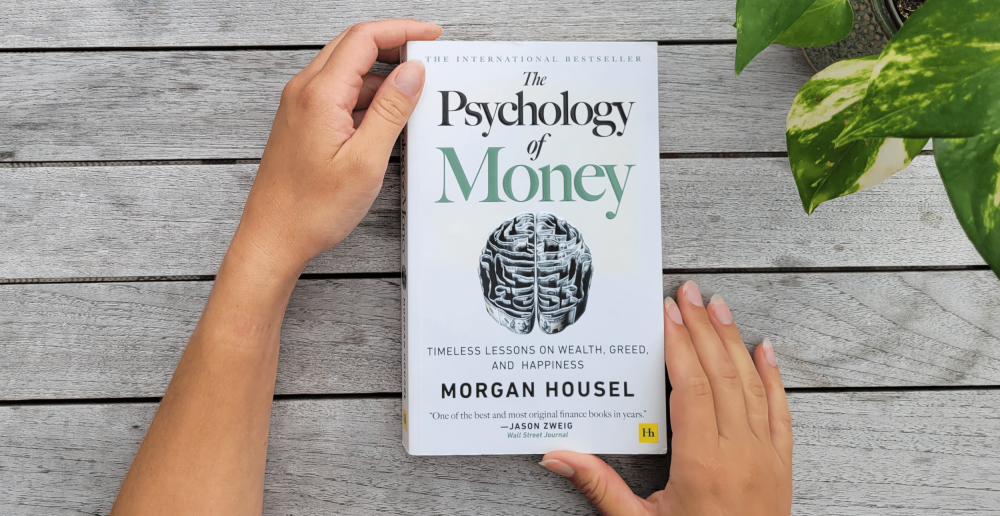

Introduction In the realm of personal finance and wealth management, few books have garnered as much attention and acclaim as “The Psychology of Money” by Morgan Housel. Released in 2020, this insightful work explores the intricate relationship between human behavior and financial success, shedding light on the psychological factors that influence our decisions around money. In this blog post, we’ll delve into a comprehensive summary of the key concepts and lessons from this enlightening book. Housel begins by challenging the conventional belief that more money equals more happiness. He argues that the real value of money lies not in its accumulation but in its ability to provide security, freedom, and peace of mind. The pursuit of wealth should be seen as a means to an end – a tool for achieving life goals rather than an end in itself. “The Psychology of Money” emphasizes the importance of time and compounding in building wealth. Housel illustrates how small, consistent contributions can lead to significant financial growth over time. By adopting a long-term perspective and staying patient, individuals can harness the power of compounding to achieve their financial goals. One of the central themes in the book is the concept of risk and how people perceive it. Housel highlights the difference between volatility and risk, explaining that short-term market fluctuations don’t necessarily equate to long-term financial risk. Understanding this distinction is crucial for making sound investment decisions and avoiding emotional reactions to market fluctuations. Housel emphasizes the role of luck in financial success and highlights the tendency to attribute success solely to one’s skills and intelligence. Recognizing the influence of luck in our lives can lead to a more humble and realistic approach to financial planning. It’s important to acknowledge both the role of skill and the role of chance in shaping our financial outcomes. Drawing from behavioral economics, the author explores various cognitive biases that impact financial decision-making. From overconfidence to loss aversion, Housel discusses how these biases can lead to suboptimal choices and financial pitfalls. Being aware of these biases is the first step toward making more rational and informed financial decisions. Housel delves into the intersection of money and relationships, emphasizing the importance of communication and shared financial goals in a partnership. By aligning financial values and fostering open conversations about money, couples can build a solid foundation for a harmonious financial life. Conclusion: “The Psychology of Money” is a thought-provoking exploration of the human side of finance. Morgan Housel’s insights into the psychological aspects of money offer a valuable perspective for anyone seeking to navigate the complex world of personal finance. By understanding the principles outlined in this book, readers can cultivate a healthier relationship with money and make more informed decisions that lead to lasting financial well-being.

Navigating the world of a 9-5 job can be both rewarding and challenging. While steady income brings stability, it’s crucial to maximize your earnings and make the most of your hard-earned money. By adopting savvy money-saving strategies, you can build a solid financial foundation, achieve your goals, and secure your future. Let’s dive into some effective tips for saving money while working a 9-5 job. 1. Craft a Detailed Budget Creating a budget is the cornerstone of effective money management. List all your monthly expenses, including essentials like rent/mortgage, utilities, groceries, and transportation. Factor in discretionary spending as well, but aim to trim unnecessary expenses. Having a clear understanding of where your money goes enables you to make informed decisions and identify areas where you can save. 2. Prioritize Debt Repayment If you have outstanding debts, prioritize paying them off as soon as possible. Start with high-interest debts (e.g., credit cards) to avoid accumulating more interest. By eliminating debts, you free up money that can be redirected towards savings and investments. 3. Pack Your Lunch Eating out regularly can quickly add up. Preparing lunch at home not only saves money but also allows you to make healthier choices. Get into the habit of bringing homemade meals to work; it’s not just a money-saver but a step towards a healthier lifestyle. 4. Limit Impulse Spending Resist the temptation of impulsive purchases. Before buying something, ask yourself if it’s a necessity or a fleeting desire. Give yourself a cooling-off period to reconsider the purchase. This simple step can save you from buyer’s remorse and keep your spending in check. 5. Automate Savings Set up automatic transfers from your paycheck to a separate savings account. This forces you to save before you even see the money, making it easier to stick to your savings goals. Treat your savings like any other non-negotiable bill, and watch your savings grow steadily. 6. Take Advantage of Employer Benefits Maximize your employee benefits. If your employer offers a retirement savings plan, such as a 401(k), contribute enough to get any company match – it’s essentially free money. Also, explore other benefits like health savings accounts (HSAs) or flexible spending accounts (FSAs) to reduce taxable income and save on medical expenses. 7. Embrace the Side Hustle Consider exploring a side gig or freelance work to supplement your income. The extra money can go directly towards your savings, debt repayment, or investments. Be sure to manage your time effectively to avoid burnout from juggling your 9-5 job and side hustle. Conclusion Saving money while working a 9-5 job requires discipline, but it’s an essential step towards financial security. By crafting a budget, prioritizing debt repayment, packing your lunch, avoiding impulse spending, automating savings, maximizing employer benefits, and exploring side gigs, you’ll build a strong financial foundation for yourself. Stay committed to your goals, and over time, you’ll reap the benefits of your wise money management choices. Remember, financial freedom is within your reach, and these money-saving tips are your roadmap to get there.

In today’s fast-paced world, effective money management is a skill that can make a world of difference in achieving your financial goals and building a secure future. Whether you’re aiming to pay off debt, save for a major purchase, or create a robust investment portfolio, these essential money management rules will serve as your compass on this financial journey. 1. Create a Budget and Stick to It Budgeting is the foundation of sound money management. It’s not about restricting yourself but rather about gaining control over your finances. Start by tracking your income and expenses. Identify your fixed costs (like rent or mortgage, utilities, and loan payments) and allocate a portion of your income to savings and investments. Monitor your spending and adjust as needed to stay within your budget. 2. Save Before You Spend Pay yourself first! This rule is the key to building a solid financial foundation. Before you allocate money for discretionary spending, set aside a portion of your income for savings and emergency funds. This ensures that you prioritize your financial future and have a safety net in case of unexpected expenses. 3. Live Below Your Means Resist the temptation to spend everything you earn. Living below your means means spending less than you make, allowing you to save, invest, and achieve your financial goals faster. It’s not about depriving yourself, but rather making mindful choices and avoiding unnecessary expenses. 4. Pay Off High-Interest Debt High-interest debt can be a significant burden on your finances. Focus on paying off debts with the highest interest rates first, such as credit card debt. Once you’ve cleared high-interest debts, you’ll free up more money to save, invest, and work toward other financial goals. 5. Diversify Your Investments Investing is a powerful tool for growing your wealth, but it’s essential to diversify. Spread your investments across different asset classes, such as stocks, bonds, real estate, and retirement accounts. Diversification helps mitigate risk and increases your chances of earning solid returns over time. 6. Continuously Educate Yourself The world of personal finance and investing is constantly evolving. Stay informed about financial trends, investment opportunities, and new money management strategies. Knowledge is your most valuable asset when it comes to making informed financial decisions. 7. Set Clear Financial Goals Having specific, measurable financial goals provides direction and motivation. Whether it’s saving for a down payment on a house, building an emergency fund, or planning for retirement, setting clear goals helps you stay focused and disciplined in your money management efforts. Conclusion By following these essential money management rules, you’ll lay the groundwork for financial success. Remember, it’s about making consistent, mindful choices and planning for the long term. With a well-structured budget, disciplined savings, strategic debt management, diversified investments, continuous education, and clear financial goals, you’ll be well on your way to achieving financial security and unlocking the doors to a brighter financial future.

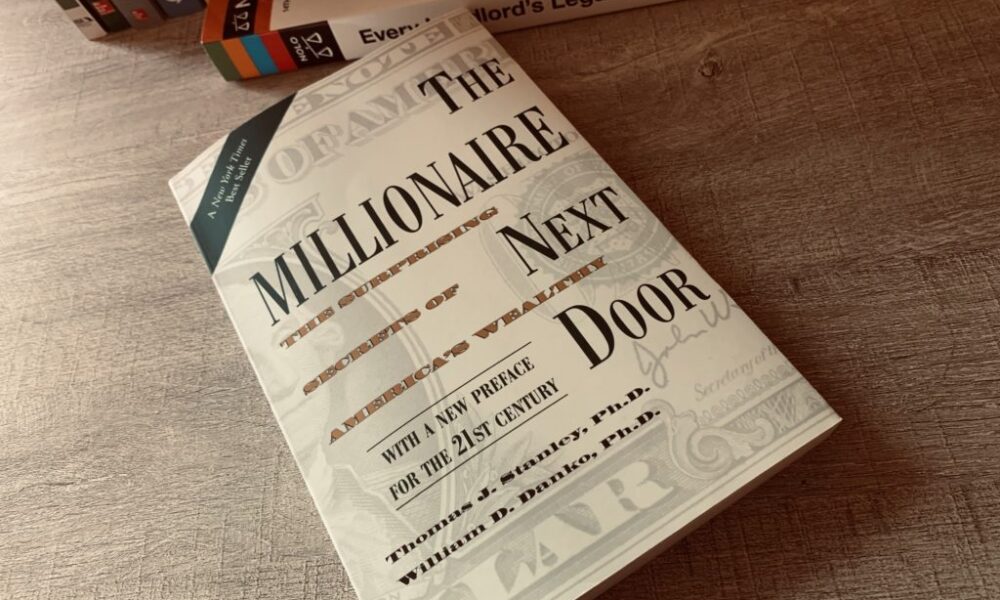

In the pursuit of financial success and the dream of achieving lasting wealth, it’s easy to imagine that millionaires have some magical formula or rare privilege that propels them to the top. However, “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy” by Thomas J. Stanley and William D. Danko turns this assumption on its head, revealing that many millionaires are not what we might expect. 1. The Myth-Busting Journey “The Millionaire Next Door” takes readers on a myth-busting journey through the lives and habits of everyday millionaires. It shatters the image of flashy spenders and showcases a different kind of millionaire – one who lives quietly, saves diligently, and avoids wasteful extravagance. This book challenges our preconceptions and provides a fresh perspective on what it truly means to build and maintain wealth. 2. The Characteristics of the Wealthy Stanley and Danko delve into the common characteristics that set millionaires apart. They highlight traits such as frugality, disciplined spending, and a commitment to saving. The book emphasizes the importance of living below one’s means, which allows individuals to accumulate wealth over time. These principles are accessible and actionable, making them applicable to anyone with the desire to improve their financial situation. 3. The Power of Consistency One of the key takeaways from the book is the power of consistency. The authors reveal that many millionaires have achieved their status through steady, incremental progress rather than sudden windfalls or extraordinary luck. This message is encouraging, as it shows that financial success is within reach for those who are willing to make consistent, prudent financial decisions and prioritize long-term goals. 4. The Roadmap to Financial Independence “The Millionaire Next Door” not only exposes the habits of millionaires but also provides a roadmap for those who want to achieve financial independence. It offers practical advice on budgeting, investing, and wealth-building strategies. The book doesn’t just tell you what not to do; it also guides you toward effective actions that can lead to lasting financial security. 5. A Book for All This book is not just for those looking to amass great wealth. It’s for anyone who wants to gain control over their finances, make smart decisions, and create a stable financial foundation. It encourages readers to shift their mindset from consumer-driven to wealth-building, empowering them to make better choices for their future. Conclusion “The Millionaire Next Door” is a timeless classic that provides valuable insights into the world of personal finance. It dismantles stereotypes about millionaires, focuses on the importance of consistent financial habits, and offers practical advice that can lead to financial independence. Whether you’re just starting on your financial journey or seeking to refine your money management skills, this book is a must-read. By embracing the lessons from “The Millionaire Next Door,” you can take control of your financial destiny and set yourself on the path to a more secure and prosperous future.

Introduction Welcome to our blog on mindful spending and the art of aligning your financial decisions with your personal values and long-term goals. In today’s fast-paced world, it’s easy to get caught up in the cycle of mindless spending, leading to financial stress and dissatisfaction. However, by adopting a mindful approach to managing your money, you can gain control over your finances and create a more meaningful and fulfilling life. In this article, we’ll delve into the concept of mindful spending and provide you with some example calculations to help you make intentional choices that reflect your values and support your financial objectives. Understanding Mindful Spending Mindful spending involves being conscious of your financial choices and understanding how they align with your values and goals. Instead of making impulsive purchases or following societal pressures, you take a moment to consider whether a specific expense brings genuine value and happiness to your life. Example Calculation 1: The Daily Coffee Habit Let’s begin with a classic example: the daily coffee habit. Imagine you buy a $5 latte every workday. Here’s the calculation to assess its impact: Monthly coffee expenses: $5/day x 20 workdays = $100Annual coffee expenses: $100/month x 12 months = $1,200 Now, ask yourself: Does this daily coffee ritual genuinely align with your values and financial goals? If it brings you joy and enhances your well-being, it might be worth keeping. However, if you realize it’s more of a habit and doesn’t significantly contribute to your happiness, you could consider cutting back or finding a more budget-friendly alternative. Example Calculation 2: Subscription Services In today’s digital age, subscription services can quickly add up and become a financial drain. Let’s calculate the annual cost of some common subscriptions: Streaming Service A: $15/month x 12 months = $180Gym Membership: $30/month x 12 months = $360Magazine Subscription: $10/month x 12 months = $120 Total annual cost: $660 Review your subscriptions and consider whether they genuinely bring value to your life. If you find that you rarely use certain services or they don’t align with your interests and goals, canceling them could free up funds for more meaningful purposes. Example Calculation 3: Impulse Purchases vs. Savings Mindful spending involves resisting impulse purchases and directing that money toward savings and investments. Consider this scenario: Impulse Purchase: $50Potential Savings Contribution: $50 If you can reduce or eliminate impulse purchases and consistently redirect that money into savings or investments, it can significantly impact your long-term financial security and help you achieve your goals sooner. Conclusion Being mindful of your spending empowers you to make financial decisions that resonate with your values and support your aspirations. By calculating the costs of various expenses and comparing them with your priorities, you can identify areas where adjustments can be made. Remember, mindful spending doesn’t mean sacrificing all indulgences; rather, it’s about making intentional choices that align with what truly matters to you. Take control of your finances today, and pave the way for a more purposeful and financially secure future.

Introduction Personal finance is a lifelong journey that starts from the moment you start earning your own money. Whether you are just starting out in your career or getting ready to retire, there are certain financial milestones that you should strive to achieve at different ages. These milestones can help you stay on track with your financial goals and ensure that you are making progress towards building wealth and financial security. In Your 20s: Building a Strong Foundation Your 20s are a time of exploration and discovery, both in your personal and professional life. However, it’s also a crucial time for building a strong financial foundation. Here are some personal finance milestones to aim for in your 20s: Creating a Budget Creating a budget is the foundation of good personal finance. It can help you understand your income, expenses, and spending habits, and identify areas where you can cut back or save more. Building an Emergency Fund An emergency fund is a safety net that can help you cover unexpected expenses, such as car repairs or medical bills. Aim to save at least three to six months’ worth of living expenses in an emergency fund. Paying off Student Loans If you have student loans, aim to pay them off as soon as possible. Making extra payments or refinancing your loans can help you save on interest and pay off your debt faster. In Your 30s: Planning for the Future Your 30s are a time of stability and growth. You may have a family, a stable career, and more financial responsibilities. Here are some personal finance milestones to aim for in your 30s: Saving for Retirement Now is the time to start saving for retirement. Aim to save at least 15% of your income in a retirement account, such as a 401(k) or IRA. Buying a Home If you’re planning to buy a home, aim to save at least 20% for a down payment. This can help you avoid private mortgage insurance (PMI) and reduce your monthly mortgage payments. Investing in the Stock Market Investing in the stock market can help you build wealth over the long term. Consider investing in a low-cost index fund or exchange-traded fund (ETF) that tracks the performance of the overall stock market. In Your 40s: Nearing Retirement Your 40s are a time of transition as you near retirement. You may have more financial responsibilities, such as paying for your children’s college education. Here are some personal finance milestones to aim for in your 40s: Paying off Debt If you still have debt, aim to pay it off as soon as possible. This can help you reduce your monthly expenses and free up more money for savings. Saving for College If you have children, start saving for their college education. Consider opening a 529 plan, which offers tax-free growth and withdrawals for qualified education expenses. Reviewing Your Retirement Plan Review your retirement plan to ensure that you are on track to meet your goals. Consider increasing your contributions if you are behind on your savings. In Your 50s and Beyond: Retiring with Confidence Your 50s and beyond are a time of reflection and preparation for retirement. Here are some personal finance milestones to aim for as you near retirement: Catching Up on Retirement Savings If you’re behind on your retirement savings, now is the time to catch up. Consider making catch-up contributions to your retirement account, which allow you to save more if you’re over age 50. Creating a Retirement Budget Creating a retirement budget can help you understand your income and expenses in retirement. Consider working with

Introduction: Passive income ideas Passive income is a stream of income that requires little to no effort to maintain. It’s the dream of many people to earn money while they sleep or are on vacation. Fortunately, there are many passive income ideas out there that can help you achieve that dream. Investing in stocks and real estate One of the most popular ways to earn passive income is through investing in stocks and real estate. Both can offer regular dividends or rental income, respectively. However, investing does come with risks, and you should do your research and seek professional advice before jumping in. Create an online course or eBook Creating an online course or eBook can be a great way to earn passive income. Once you’ve created your content, you can sell it on platforms like Udemy, Coursera, or Amazon Kindle. The best part is that you can continue to earn money from your content long after you’ve finished creating it. Sell digital products If you have a talent for creating digital products like graphics, software, or even music, you can sell them on platforms like Etsy or Creative Market. This is a great way to earn passive income because once you’ve created the product, you can sell it over and over again. Create a YouTube channel or podcast Creating a YouTube channel or podcast can be a great way to earn passive income. Once you’ve built up a following, you can monetize your content with ads, sponsorships, and merchandise sales. Rent out your property on Airbnb If you have a spare room or a vacation home, you can rent it out on Airbnb. This is a great way to earn passive income because you don’t have to do much work besides cleaning and maintaining the property. Affiliate marketing Affiliate marketing is a type of marketing where you earn a commission for promoting other people’s products. You can do this through your blog, social media accounts, or YouTube channel. This can be a great way to earn passive income if you have a large following. Conclusion There are many passive income ideas out there, and these are just a few of them. Remember, passive income doesn’t mean no work at all, but rather it means that the work you put in upfront can continue to earn you money over time. So, start exploring these passive income ideas and find the ones that work best for you! Thanks for reading this “6 passive income ideas ” article, If you really loved it. please consider subscribing to Refill wealth

Introduction save money is something that everyone wants to do, but sometimes it can be difficult to know where to start. One effective strategy is to cut back on unnecessary expenses. In this article, we’ll explore some common expenses that you can cut to save money. Evaluate Your Monthly Bills to save money One of the first things you should do is evaluate your monthly bills. Are there any services you pay for that you don’t really need or could cut back on? For example, do you have a premium cable package or a subscription to a streaming service that you don’t use often? Consider cutting back or canceling these services altogether. Reduce Your Transportation Costs Another common expense to cut back on is transportation costs. If you own a car, consider carpooling or taking public transportation instead of driving alone. This can help you save money on gas, car maintenance, and insurance. Additionally, you might consider walking or biking instead of driving short distances. Cut Back on Eating Out Eating out can be a significant expense for many people. Try to cut back on this expense by cooking at home more often. Not only can you save money, but you’ll likely eat healthier meals as well. If you do want to eat out, look for coupons or deals to help reduce the cost. Review Your Entertainment Expenses Entertainment can also be a costly expense. Look at your spending habits and see if there are any areas where you can cut back. For example, if you go to the movies often, consider waiting for movies to come out on DVD or streaming services. You could also consider finding free or low-cost events in your community for entertainment. Shop Smarter for Groceries Groceries are a necessity, but they don’t have to be expensive. Shop smarter by making a list before you go to the store and sticking to it. Buy store-brand products instead of name-brand items, and consider purchasing items in bulk to save money in the long run. Re-evaluate Your Subscriptions Finally, take a look at any subscriptions you have. Are there any you don’t use often or at all? Consider canceling them to save money. Additionally, if you have subscriptions to multiple services, see if there are any bundled options available that could save you money. Conclusion Cutting back on expenses can be an effective way to save money. By evaluating your monthly bills, reducing your transportation costs, cutting back on eating out, reviewing your entertainment expenses, shopping smarter for groceries, and re-evaluating your subscriptions, you can take control of your finances and save money. Remember, every little bit helps, so start small and work your way up to bigger changes.