Photo by Sasun Bughdaryan on Unsplash Are you tired of feeling like you’re always living paycheck to paycheck? Do you struggle to How to save money every month? If so, you’re not alone. Many people struggle with the same issue. Fortunately, there are steps you can take to save money and improve your financial situation. Start with an Example Now we can see a real-time example to save your money every month, Do you like coffee? One practical example of how to save money is by cutting back on your daily coffee habit. If you’re used to buying a $4 coffee every day, that adds up to $120 per month. Instead, consider brewing your own coffee at home or at work. Invest in a good quality coffee maker and buy your favorite coffee beans in bulk. This way, you can still enjoy your morning cup of joe without spending a lot of money. Over the course of a year, this small change could save you up to $1,440! Another practical example of how to save money is by buying generic or store-brand products instead of name-brand products. Often, the generic or store-brand products are just as good as the name-brand products, but at a much lower cost. You can save money on groceries, cleaning products, and other household items by choosing the generic or store-brand option. Over time, these small savings can add up to a significant amount of money. Okay, Let’s get into this blog post, we’ll cover some practical tips on how to save money every month. Create a budget The first step to saving money is creating a budget. This will help you understand where your money is going each month and identify areas where you can cut back. Start by listing all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Then, compare your total expenses to your income. If you’re spending more than you’re earning, you’ll need to make some adjustments. Use Spreadsheets or Budgeting application creating a budget done by using a spreadsheet or budgeting app. Start by listing all of your monthly income sources, such as your salary, freelance work, or any other sources of income. Then, list all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Assign a dollar amount to each expense category and subtract the total expenses from the total income to see if you have a surplus or deficit. This will give you a clear picture of where your money is going each month and where you may need to adjust your spending. You can also use a budgeting app like Mint or YNAB to automatically track your spending and categorize your expenses. This way, you can easily see how much you’re spending in each category and identify areas where you can cut back. Cut back on unnecessary expenses Once you’ve created a budget, look for ways to cut back on unnecessary expenses. For example, do you really need that gym membership you never use? Or, could you save money by cooking at home instead of eating out? Look for small changes you can make that will add up over time. Set financial goals & save money Setting financial goals is a great way to stay motivated and on track. Start by setting a savings goal for each month. This could be as simple as saving $50 or $100. As you become more comfortable with saving, you can increase your goals. One practical example of setting financial goals is creating an emergency fund. This fund can be used to cover unexpected expenses, such as car repairs or medical bills, without having to rely on credit cards or loans. Start by setting a goal to save a certain amount, such as $1,000 or $2,000, and then make a plan to reach that goal. You can set up automatic transfers from your checking account to your emergency fund each month, or allocate a portion of your tax refund or bonus to the fund. By setting this financial goal and making a plan to achieve it, you’ll be prepared for unexpected expenses and avoid going into debt. Use apps and tools to help you save money There are many apps and tools available that can help you save money. For example, some apps will automatically save small amounts of money from your checking account each week. Others will help you find coupons and deals to save money on your purchases. I will Suggest Wallet & Bluecoins Mobile applications to track your money. I’m using these two tools for the past two years. It’s amazing. Pay yourself first One of the most effective ways to save money is to pay yourself first. This means setting aside a portion of your income for savings before you pay your bills or spend money on anything else. Even if it’s just a small amount, paying yourself first will help you develop the habit of saving. Conclusion: How to save money every month Expense Category Monthly Expense Money-Saving Strategies Housing $1,200 (rent) Consider downsizing to a smaller apartment or finding a roommate to split rent costs. Utilities $150 Turn off lights and electronics when not in use, adjust thermostat by a few degrees, switch to energy-efficient light bulbs. Transportation $200 Carpool to work, walk or bike instead of driving short distances, use public transportation. Food $500 Plan meals in advance and make a grocery list, cook at home instead of eating out, buy generic or store-brand products. Entertainment $100 Look for free or low-cost activities, such as hiking or visiting museums, instead of expensive outings. Total Monthly Expenses $2,150 Money-Saving Goal: Reduce monthly expenses by 10% by cutting back on unnecessary expenses and finding ways to save money. Sample Monthly Budgeting By identifying your monthly expenses and finding ways to reduce them, you can set a goal to save a certain percentage each month. In this example, the goal is to reduce monthly expenses by 10% and

Retirement Planning Mistakes to Avoid: Tips and Strategies for a Worry-Free Future Retirement planning mistakes, Retirement is a time to enjoy the fruits of your labor and live the life you’ve always wanted. But without proper planning, retirement can quickly turn into a nightmare. To ensure a secure and worry-free future, it’s essential to avoid common retirement planning mistakes that can undermine your financial stability. In this article, we’ll cover the top retirement planning mistakes to avoid and provide tips and strategies to help you make the most of your retirement savings. So, let’s get started! Mistake #1: Not starting early enough One of the biggest mistakes people make when it comes to retirement planning is not starting early enough. It’s essential to start saving for retirement as early as possible to take advantage of the power of compound interest. Even small contributions can make a big difference over time. Tip: Start contributing to a retirement savings account as soon as you start earning an income. Consider using tax-advantaged retirement accounts like a 401(k) or IRA to maximize your savings potential. Mistake #2: Failing to plan for healthcare costs Healthcare costs can quickly eat away at your retirement savings, especially as you age. Failing to plan for healthcare costs can leave you with little money to cover medical expenses, leading to financial stress and uncertainty. Tip: Make sure to factor in healthcare costs when planning for retirement. Consider purchasing long-term care insurance or a Medicare supplement policy to help cover potential expenses. Mistake #3: Underestimating retirement expenses Many people make the mistake of underestimating how much money they’ll need in retirement. Failing to account for inflation and unexpected expenses can leave you with a retirement income shortfall. Tip: Create a detailed retirement budget that accounts for all your expenses, including travel, hobbies, and healthcare costs. Don’t forget to factor in inflation and potential emergencies to ensure you have enough savings to last throughout your retirement. Mistake #4: Taking on too much debt Carrying too much debt into retirement can severely impact your financial stability. High-interest debt like credit card debt can quickly eat away at your savings, leaving you with little money to cover essential expenses. Tip: Make a plan to pay off debt before retirement. Consider working with a financial advisor to develop a debt repayment plan that aligns with your retirement goals. Mistake #5: Failing to diversify your investments Investing all your retirement savings in one asset class can leave you vulnerable to market volatility and potential losses. Failing to diversify your investments can severely impact your retirement income and overall financial security. Tip: Consider diversifying your retirement portfolio across multiple asset classes, such as stocks, bonds, and real estate. Make sure to rebalance your portfolio regularly to maintain your desired asset allocation. Here’s an example of how you can save for retirement with calculations: Let’s say you’re 25 years old and want to retire at age 65 with a retirement income of $60,000 per year in today’s dollars. Assuming a 3% inflation rate, your retirement income needs will be approximately $142,456 per year when you reach 65. To calculate how much you need to save for retirement, you’ll need to consider several factors: Using these factors, you can use a retirement calculator to determine how much you need to save each year to reach your retirement goals. Let’s assume that you plan to save for 40 years, starting at age 25 and ending at age 65. Using a retirement calculator, you would need to save approximately $1,890 per month, or $22,680 per year, assuming a 5% rate of return. By the time you reach age 65, you will have saved approximately $907,200. Assuming a 4% withdrawal rate in retirement, you will be able to generate $36,288 in annual income, or approximately $3,024 per month. Of course, this is just one example, and your retirement savings plan will depend on your individual circumstances, such as your current savings, your retirement goals, and your risk tolerance. It’s always a good idea to consult with a financial advisor who can help you create a customized retirement savings plan that meets your unique needs and circumstances. In conclusion, retirement planning is essential for a worry-free future, but it’s crucial to avoid common mistakes that can undermine your financial security. By starting early, planning for healthcare costs, accounting for inflation and unexpected expenses, paying off debt, and diversifying your investments, you can secure your financial future and enjoy a worry-free retirement. We hope Retirement planning tips has provided you with valuable insights and strategies to help you avoid retirement mistakes. If you have any questions or would like to learn more about retirement planning, please don’t hesitate to reach out to a qualified financial advisor.

In today’s world, it’s important to take control of your finances and create a budget that works for you and your lifestyle. Budgeting can help you maximize your income, save money, and achieve your financial goals. However, creating a budget can seem daunting, especially if you’re not sure where to start. In this blog post, we’ll discuss how to create a budget that works for you and your lifestyle. Step 1: Calculate Your Income The first step in creating a budget is to calculate your income. This includes your salary, bonuses, and any other sources of income. It’s important to be accurate when calculating your income, as this will help you determine how much you can afford to spend and save each month. Step 2: Track Your Expenses The next step is to track your expenses. This includes everything from rent and utilities to groceries and entertainment. You can use a spreadsheet or budgeting app to track your expenses, or simply write them down on a piece of paper. The key is to be as detailed as possible and to include all of your expenses. Step 3: Categorize Your Expenses Once you’ve tracked your expenses, it’s time to categorize them. This will help you see where your money is going and where you can cut back. Common expense categories include housing, transportation, food, entertainment, and debt payments. Step 4: Set Goals Now that you know how much you’re earning and spending, it’s time to set some financial goals. These goals can include things like paying off debt, saving for a down payment on a house, or investing for retirement. It’s important to set realistic goals that you can achieve within a reasonable timeframe. Step 5: Create a Budget With all of this information in hand, it’s time to create a budget. Start by listing your income at the top of the page, then subtract your expenses. If you have money left over, this is your disposable income. If you’re in the red, it’s time to look for ways to cut back on expenses or increase your income. Step 6: Monitor Your Budget Creating a budget is just the first step. You also need to monitor your budget regularly to ensure you’re staying on track. This means tracking your expenses and income each month and making adjustments as needed. You may also want to set up alerts or reminders to help you stay on top of your budget. Maximizing your income is all about taking control of your finances and creating a budget that works for you and your lifestyle. By following these steps, you can create a budget that will help you achieve your financial goals and live the life you want. Remember, budgeting is a process, so don’t be afraid to make adjustments and try new things until you find a budget that works for you.

Image by freepik Money management is a crucial skill that young adults must develop as they transition into independence. Whether it’s paying bills, saving for the future, or investing in assets, having a solid grasp of financial literacy is essential. Unfortunately, many young adults struggle with managing their finances, leading to debt and financial instability. To help you avoid these pitfalls, we’ve compiled a list of ten essential money management rules for young adults. Create a budget: Creating a budget is the foundation of sound money management. Start by listing all of your sources of income and all of your expenses, including rent, bills, groceries, and discretionary spending. Then, track your spending to ensure that you’re sticking to your budget. Live within your means: Avoid the temptation to overspend by living within your means. This means not buying things you can’t afford and not relying on credit cards to fund your lifestyle. Instead, prioritize your expenses and focus on what you need rather than what you want. Set financial goals: Setting financial goals can help you stay motivated and on track. Whether it’s saving for a down payment on a house or paying off student loans, having a clear goal in mind will make it easier to stick to your budget. Start an emergency fund: Unexpected expenses can quickly derail your financial stability. That’s why it’s essential to start an emergency fund that can cover at least three to six months of living expenses. Put aside a small portion of your income each month into a separate savings account to build up your emergency fund. Pay off high-interest debt: High-interest debt, such as credit card balances, can quickly accumulate and become unmanageable. Focus on paying off high-interest debt first to reduce the amount of interest you’re paying and improve your credit score. Avoid unnecessary expenses: It’s easy to get caught up in the latest trends and fads, but avoid unnecessary expenses that don’t add value to your life. Instead, focus on experiences and activities that bring you joy and fulfillment without breaking the bank. Invest in your future: Investing in your future is crucial to long-term financial stability. Whether it’s investing in your education, retirement, or real estate, make sure you’re putting money aside for your future. Track your credit score: Your credit score is a crucial factor in your financial health. It affects your ability to borrow money, obtain credit cards, and even rent an apartment. Use credit monitoring tools to track your credit score and take steps to improve it if necessary. Negotiate bills and expenses: Don’t be afraid to negotiate bills and expenses to save money. You can often negotiate lower rates on bills such as cable and internet, and even negotiate your salary at work. Learn from your mistakes: Finally, don’t beat yourself up if you make financial mistakes. Instead, use them as learning opportunities to improve your money management skills and avoid making the same mistakes in the future. In conclusion, managing your finances as a young adult is crucial to your long-term financial health. By following these ten essential money management rules, you’ll be well on your way to financial stability and success. Remember, it’s never too early to start building good money management habits.

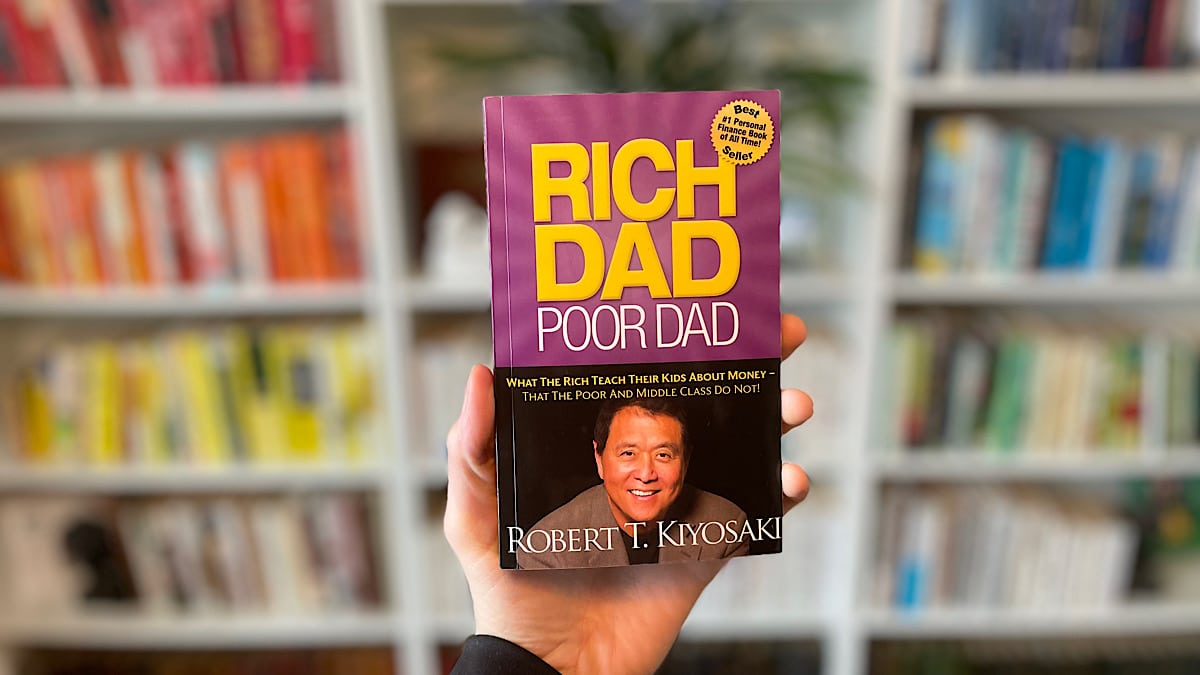

“Rich Dad Poor Dad” is a book written by Robert Kiyosaki that has had a significant impact on personal finance and wealth creation. Published in 1997, it has sold over 32 million copies in over 40 languages worldwide, making it one of the most popular personal finance books ever written. This book is written in a storytelling format and is based on Kiyosaki’s personal experiences with his own “rich dad” and “poor dad.” The main premise of the book is that financial education is not taught in schools, and many people are not equipped with the knowledge and skills to manage their finances effectively. The book offers a different perspective on money and wealth, challenging traditional beliefs about work, saving, and investing. In the book, Kiyosaki shares two contrasting stories of his two fathers – his biological father, who he refers to as the “poor dad,” and his friend’s father, who he calls the “rich dad.” He uses their stories to illustrate different approaches to money management and financial education. Kiyosaki’s poor dad was a highly educated man who worked hard and had a good job but struggled financially. He believed in getting a good education, getting a stable job, and saving money for retirement. His rich dad, on the other hand, was a self-made millionaire who had built his wealth through entrepreneurship and investing. One of the key takeaways from the book is the importance of financial literacy. Kiyosaki argues that financial literacy is not just about knowing how to budget and save money, but also about understanding the difference between assets and liabilities, understanding taxes, and understanding how to use leverage to build wealth. Kiyosaki also highlights the importance of investing in assets that generate income, such as real estate or stocks, rather than just saving money in a bank account. He emphasizes the value of taking calculated risks and stepping outside of one’s comfort zone to create wealth. Another important message from the book is the concept of “paying yourself first.” Kiyosaki argues that people should prioritize investing in themselves and their financial future by setting aside a portion of their income for investing, rather than just living paycheck to paycheck. The book also challenges the traditional idea of job security and encourages readers to explore entrepreneurship and creating their own businesses. Kiyosaki argues that relying solely on a job for income is risky, and that building one’s own business can provide more financial freedom and stability. Overall, “Rich Dad Poor Dad” offers a fresh perspective on personal finance and wealth creation, challenging traditional beliefs and offering practical advice for building wealth. The book emphasizes the importance of financial education, investing in assets that generate income, and taking calculated risks to achieve financial freedom.

When it comes to achieving financial goals, budgeting is key. By setting a budget, you can take control of your spending and start saving more money. However, the idea of budgeting can be daunting for some, leading them to put it off altogether. But the truth is, budgeting doesn’t have to be complicated or time-consuming. In fact, there are several simple strategies you can use to help you save money and achieve your financial goals. Here are five budgeting strategies to get you started: Track Your Spending The first step in creating a budget is to understand where your money is going. Start by tracking your spending for a month or two. This can be done manually or with the help of a budgeting app. Make a list of all your expenses, including bills, groceries, and entertainment. Seeing your spending habits on paper will give you a better understanding of where your money is going and where you may be able to cut back. Set Goals Once you have a clear understanding of your spending habits, it’s time to set some financial goals. Do you want to pay off debt? Save for a down payment on a house? Start a retirement fund? Whatever your goals may be, make them specific, measurable, and realistic. Having a clear goal in mind will help you stay motivated and focused on your budget. Use the 50/30/20 Rule The 50/30/20 rule is a popular budgeting strategy that involves dividing your income into three categories: 50% for needs, 30% for wants, and 20% for savings. Needs include things like rent, groceries, and bills, while wants include things like entertainment and dining out. The 20% category is for saving and investing. By following this rule, you can ensure that you’re covering your essential expenses, while also leaving room for fun and saving for the future. Cut Back on Non-Essential Expenses One of the easiest ways to save money is by cutting back on non-essential expenses. Take a look at your spending habits and identify areas where you could cut back. Maybe you can pack your lunch instead of eating out every day, or cancel a subscription service you don’t use. Cutting back on small expenses can add up quickly and help you save more money each month. Use Cash Envelopes If you struggle with overspending on certain categories, consider using cash envelopes. This involves setting a budget for each category and withdrawing cash to put into envelopes labeled with the category name. For example, you may have an envelope for groceries, entertainment, and gas. Once the cash in the envelope is gone, you can’t spend any more money in that category until the next month. This is a great way to keep yourself accountable and avoid overspending. In conclusion, budgeting doesn’t have to be overwhelming. By following these simple strategies, you can take control of your finances, save more money, and achieve your financial goals. Remember, the key is to start small and stay consistent. Over time, you’ll see the benefits of your hard work and dedication to your budget.

Budgeting is an essential skill that everyone should learn. It helps you track your expenses, save money, and achieve your financial goals. However, creating a realistic budget is not enough. Sticking to it can be challenging, especially if you don’t have the discipline to follow through. In this blog, we will discuss how to make a realistic budget and how to stick to it. Step 1: Determine Your Income The first step in creating a budget is to determine your income. This includes all sources of income, such as your salary, bonuses, and side hustles. If you have a variable income, calculate an average based on the last few months. Once you have your total income, you can move on to the next step. Step 2: List Your Expenses The next step is to list all your expenses. This includes fixed expenses, such as rent, mortgage payments, and utility bills, and variable expenses, such as groceries, entertainment, and clothing. Don’t forget to include periodic expenses, such as car insurance and property taxes, that may not occur every month. Step 3: Categorize Your Expenses Once you have listed all your expenses, categorize them into essential and non-essential expenses. Essential expenses are those that you must pay to maintain your basic needs, such as food, shelter, and transportation. Non-essential expenses are those that you can live without, such as dining out and shopping. Step 4: Set Your Financial Goals The next step is to set your financial goals. Do you want to save for a down payment on a house, pay off your student loans, or build an emergency fund? Once you have set your financial goals, you can allocate a portion of your income towards achieving them. Step 5: Determine Your Budget Now that you have a clear understanding of your income, expenses, and financial goals, you can create a budget. Start by subtracting your essential expenses from your income. This will give you a clear picture of how much money you have left to spend on non-essential expenses and savings. Step 6: Monitor Your Spending Creating a budget is only the first step. To stick to your budget, you need to monitor your spending regularly. Use a budgeting app or a spreadsheet to track your expenses and compare them to your budget. This will help you identify areas where you are overspending and make adjustments accordingly. Step 7: Find Ways to Cut Costs If you find that you are overspending in certain areas, look for ways to cut costs. For example, you can reduce your dining out expenses by cooking at home more often or shop for groceries at a cheaper store. You can also cancel subscriptions that you don’t use or negotiate lower rates for your bills. Step 8: Reward Yourself Sticking to a budget can be challenging, but it’s important to reward yourself for your hard work. Set small goals and reward yourself when you achieve them. For example, if you save a certain amount of money, treat yourself to a nice dinner or buy something you’ve been wanting. In conclusion, creating a realistic budget and sticking to it requires discipline and commitment. By following these eight steps, you can create a budget that works for you and achieve your financial goals. Remember to monitor your spending regularly, look for ways to cut costs, and reward yourself for your hard work. With a little effort, you can take control of your finances and build a better future for yourself.