“Rich Dad Poor Dad” is a book written by Robert Kiyosaki that has had a significant impact on personal finance and wealth creation. Published in 1997, it has sold over 32 million copies in over 40 languages worldwide, making it one of the most popular personal finance books ever written. This book is written in a storytelling format and is based on Kiyosaki’s personal experiences with his own “rich dad” and “poor dad.” The main premise of the book is that financial education is not taught in schools, and many people are not equipped with the knowledge and skills to manage their finances effectively. The book offers a different perspective on money and wealth, challenging traditional beliefs about work, saving, and investing. In the book, Kiyosaki shares two contrasting stories of his two fathers – his biological father, who he refers to as the “poor dad,” and his friend’s father, who he calls the “rich dad.” He uses their stories to illustrate different approaches to money management and financial education. Kiyosaki’s poor dad was a highly educated man who worked hard and had a good job but struggled financially. He believed in getting a good education, getting a stable job, and saving money for retirement. His rich dad, on the other hand, was a self-made millionaire who had built his wealth through entrepreneurship and investing. One of the key takeaways from the book is the importance of financial literacy. Kiyosaki argues that financial literacy is not just about knowing how to budget and save money, but also about understanding the difference between assets and liabilities, understanding taxes, and understanding how to use leverage to build wealth. Kiyosaki also highlights the importance of investing in assets that generate income, such as real estate or stocks, rather than just saving money in a bank account. He emphasizes the value of taking calculated risks and stepping outside of one’s comfort zone to create wealth. Another important message from the book is the concept of “paying yourself first.” Kiyosaki argues that people should prioritize investing in themselves and their financial future by setting aside a portion of their income for investing, rather than just living paycheck to paycheck. The book also challenges the traditional idea of job security and encourages readers to explore entrepreneurship and creating their own businesses. Kiyosaki argues that relying solely on a job for income is risky, and that building one’s own business can provide more financial freedom and stability. Overall, “Rich Dad Poor Dad” offers a fresh perspective on personal finance and wealth creation, challenging traditional beliefs and offering practical advice for building wealth. The book emphasizes the importance of financial education, investing in assets that generate income, and taking calculated risks to achieve financial freedom.

The Intelligent Investor, written by Benjamin Graham, is considered to be one of the most influential investment books of all time. First published in 1949, the book has been updated several times and has remained a popular guide for investors looking to make wise investment decisions. In this blog, we will provide a detailed summary of The Intelligent Investor, highlighting its key ideas and insights. The book begins by discussing the difference between investing and speculation. Graham argues that investors aim to preserve capital and earn a reasonable return, while speculators take on high levels of risk with the hope of making a quick profit. He also emphasizes the importance of avoiding short-term market fluctuations and instead focusing on long-term investment strategies. Graham then introduces his concept of value investing, which involves buying stocks that are undervalued by the market. He argues that investors should look for companies with a strong financial position, stable earnings, and a long history of profitability. By buying these stocks at a discount, investors can benefit from the market’s eventual recognition of the company’s true value. The book also covers the importance of diversification, as investing in a variety of stocks can help to reduce risk. Graham suggests that investors should aim to hold at least 10-30 stocks in their portfolio, with no more than 10% of their total assets invested in any one stock. Another key concept in The Intelligent Investor is the idea of a margin of safety. Graham suggests that investors should only buy stocks when the market price is significantly below the company’s intrinsic value. This provides a margin of safety, as even if the stock’s value were to decrease, the investor would still have a cushion of protection against losses. The book also covers the importance of analyzing financial statements, as they provide valuable information about a company’s financial health. Graham suggests that investors should focus on the company’s earnings, assets, liabilities, and cash flow, and avoid relying too heavily on stock prices or market trends. In addition to these key concepts, The Intelligent Investor also discusses various investment vehicles, including bonds, mutual funds, and index funds. Graham provides guidance on how to select the most suitable investments based on an individual’s goals, risk tolerance, and investment horizon. Overall, The Intelligent Investor is a comprehensive guide to value investing, providing valuable insights into the world of investing and how to make informed investment decisions. It emphasizes the importance of patience, discipline, and a long-term investment horizon, and provides practical advice on how to analyze financial statements, diversify portfolios, and select the most suitable investments. Whether you are a beginner or an experienced investor, The Intelligent Investor is a must-read book that can help you achieve your investment goals.

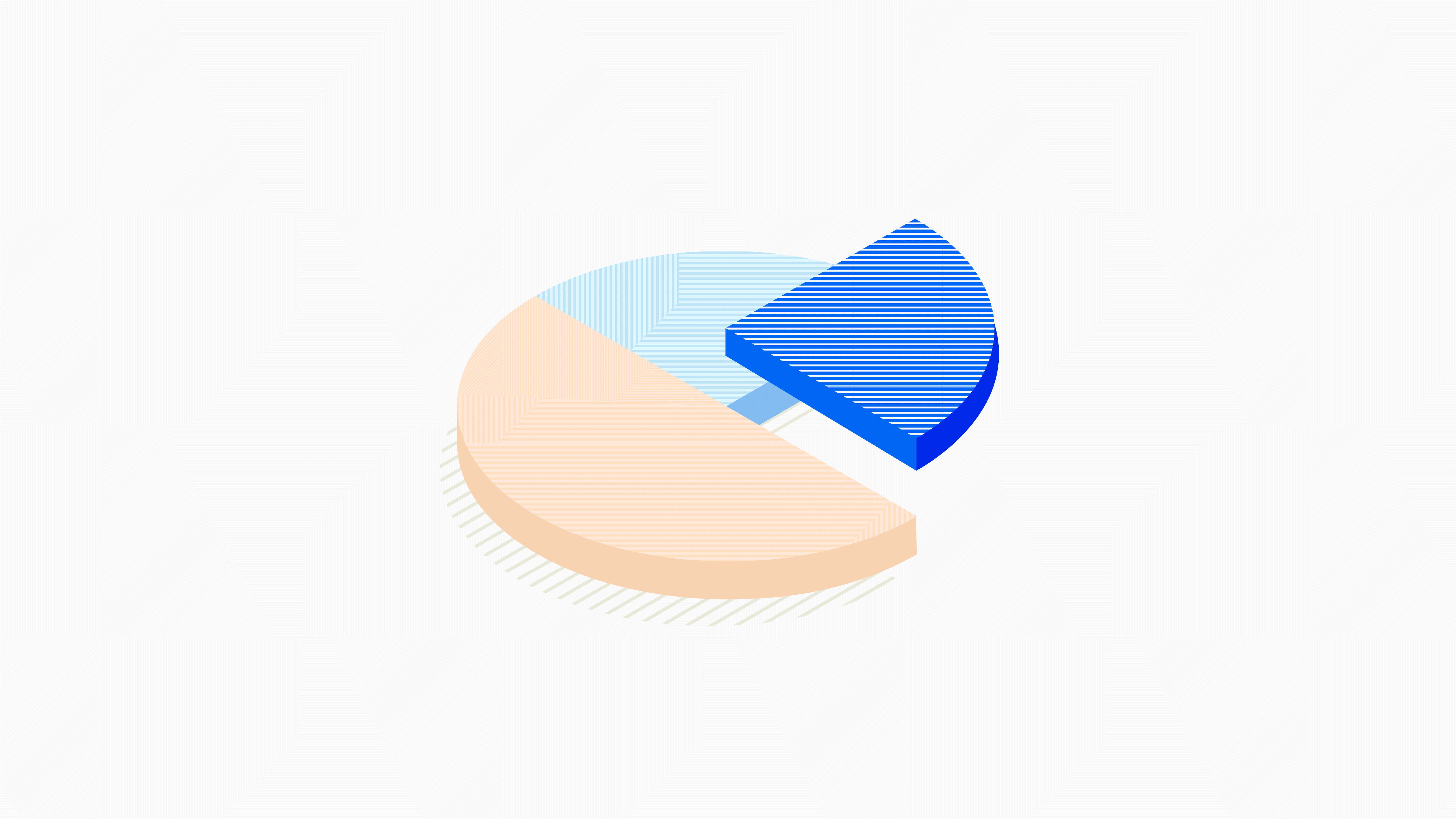

When it comes to achieving financial goals, budgeting is key. By setting a budget, you can take control of your spending and start saving more money. However, the idea of budgeting can be daunting for some, leading them to put it off altogether. But the truth is, budgeting doesn’t have to be complicated or time-consuming. In fact, there are several simple strategies you can use to help you save money and achieve your financial goals. Here are five budgeting strategies to get you started: Track Your Spending The first step in creating a budget is to understand where your money is going. Start by tracking your spending for a month or two. This can be done manually or with the help of a budgeting app. Make a list of all your expenses, including bills, groceries, and entertainment. Seeing your spending habits on paper will give you a better understanding of where your money is going and where you may be able to cut back. Set Goals Once you have a clear understanding of your spending habits, it’s time to set some financial goals. Do you want to pay off debt? Save for a down payment on a house? Start a retirement fund? Whatever your goals may be, make them specific, measurable, and realistic. Having a clear goal in mind will help you stay motivated and focused on your budget. Use the 50/30/20 Rule The 50/30/20 rule is a popular budgeting strategy that involves dividing your income into three categories: 50% for needs, 30% for wants, and 20% for savings. Needs include things like rent, groceries, and bills, while wants include things like entertainment and dining out. The 20% category is for saving and investing. By following this rule, you can ensure that you’re covering your essential expenses, while also leaving room for fun and saving for the future. Cut Back on Non-Essential Expenses One of the easiest ways to save money is by cutting back on non-essential expenses. Take a look at your spending habits and identify areas where you could cut back. Maybe you can pack your lunch instead of eating out every day, or cancel a subscription service you don’t use. Cutting back on small expenses can add up quickly and help you save more money each month. Use Cash Envelopes If you struggle with overspending on certain categories, consider using cash envelopes. This involves setting a budget for each category and withdrawing cash to put into envelopes labeled with the category name. For example, you may have an envelope for groceries, entertainment, and gas. Once the cash in the envelope is gone, you can’t spend any more money in that category until the next month. This is a great way to keep yourself accountable and avoid overspending. In conclusion, budgeting doesn’t have to be overwhelming. By following these simple strategies, you can take control of your finances, save more money, and achieve your financial goals. Remember, the key is to start small and stay consistent. Over time, you’ll see the benefits of your hard work and dedication to your budget.

Coffee Can Investing is a book written by Saurabh Mukherjea, the founder of Marcellus Investment Managers, a leading investment firm in India. The book offers insights into the long-term investing strategy of buying and holding high-quality stocks for a decade or more. In this blog, we will summarize the key takeaways from the book and explain why it’s an important read for anyone interested in long-term investing. The concept of “Coffee Can Investing” comes from an old practice of Indian households in the past where they would collect savings in a coffee can or a jar, and forget about it for a long time. The same philosophy can be applied to investing in stocks, where investors should buy high-quality stocks and hold them for a long time, without worrying about short-term market fluctuations. The book explains that investors should focus on investing in companies that have a sustainable competitive advantage, a strong management team, and are backed by a solid financial track record. These companies should have a clear growth trajectory and should be operating in a sector that is growing at a steady pace. The author suggests that investors should avoid companies that are too heavily regulated, or those that are involved in sectors with a lot of uncertainty. One of the most important takeaways from the book is the concept of “winner takes all” in the stock market. The author explains that in many sectors, a few dominant players emerge, who capture most of the market share and reap all the benefits. For example, in the technology sector, companies like Google, Facebook, and Amazon have a dominant position, and it’s unlikely that new players will be able to challenge their market share. Investors should focus on investing in such dominant players, as they are likely to generate strong returns in the long run. The book also emphasizes the importance of patience and discipline in long-term investing. The author suggests that investors should buy stocks only when they are available at an attractive price, and should not sell them until there is a clear reason to do so. Investors should avoid the temptation to trade frequently or to try to time the market, as this can lead to suboptimal returns. Another key takeaway from the book is the importance of diversification. While the author suggests that investors should focus on a few high-quality stocks, they should also diversify their portfolio across different sectors and industries. This helps to mitigate risks and ensures that the portfolio is not overly concentrated in a single sector. In summary, Coffee Can Investing is a must-read book for anyone interested in long-term investing. The book provides a clear and concise framework for investing in high-quality stocks and emphasizes the importance of patience, discipline, and diversification. By following the principles outlined in the book, investors can generate strong returns over the long run and build a robust investment portfolio.

Image by freepik Retirement is a time that many people look forward to after decades of hard work. It is a time to relax, travel, spend time with family and friends, and pursue hobbies and interests that you may not have had the time or opportunity to pursue before. However, to enjoy a comfortable and financially secure retirement, early retirement planning is essential. Early retirement planning is the process of preparing for retirement as soon as possible, preferably in your 20s or 30s. The earlier you start planning, the more time you have to save and invest, and the better your chances of achieving your retirement goals. In this blog, we will discuss the importance of early retirement planning and how it can set you up for success in your golden years. Provides Time to Save and Invest One of the most significant advantages of early retirement planning is that it provides you with ample time to save and invest. The earlier you start saving, the more time you have for your investments to grow and compound, resulting in a more significant nest egg in retirement. For example, suppose you start saving $500 per month at the age of 25 and invest it in a retirement account that earns an average annual return of 7%. By the time you reach 65, you will have accumulated over $1.1 million. However, if you wait until you are 35 to start saving the same amount, you will have only about half as much at retirement. Reduces Dependence on Social Security Many people believe that Social Security will provide enough income for them to live on in retirement. However, the reality is that Social Security benefits may not be sufficient to cover all of your expenses in retirement, especially if you want to maintain your current lifestyle. Early retirement planning can help you reduce your dependence on Social Security by building a substantial retirement nest egg. This way, you can supplement your Social Security benefits with your savings and investments, providing you with a more comfortable retirement. Enables You to Retire Earlier Early retirement planning can also help you retire earlier. With enough savings and investments, you may be able to retire before the traditional retirement age of 65, allowing you to enjoy more years of retirement and pursue your interests and hobbies. However, retiring early requires careful planning and consideration of your financial situation. You must make sure that you have enough savings to cover your expenses and that you can maintain your lifestyle throughout your retirement years. Provides Peace of Mind Early retirement planning can provide you with peace of mind, knowing that you have a solid financial plan in place for your retirement years. It can help you feel more confident about your financial future and reduce the stress and anxiety that many people feel about retirement. Moreover, early retirement planning allows you to take control of your financial future, which can be empowering. You can make informed decisions about your investments and retirement savings, ensuring that you are on track to meet your goals. Helps You Achieve Your Retirement Goals Early retirement planning can help you achieve your retirement goals. Whether you want to travel the world, spend more time with your family and friends, or pursue your passions and interests, early retirement planning can help you make it a reality. By setting clear retirement goals and developing a financial plan to achieve them, you can take the necessary steps to make your dreams a reality. Moreover, early retirement planning allows you to adjust your plan over time, ensuring that you stay on track to meet your goals. Conclusion Early retirement planning is essential for anyone who wants to enjoy a comfortable and financially secure retirement. It provides you with time to save and invest, reduces your dependence on Social Security, enables you to retire earlier, provides peace of mind, and helps you achieve your retirement goals. So, if you haven’t started planning for your retirement, now is

Many people dream of becoming a crorepati, which means having a net worth of 1 crore rupees or more. However, the path to achieving this goal can seem daunting, especially for those with a modest salary. Can you reach the 1 crore milestone with a salary of just 20,000 rupees per month? The answer is yes, but it will require careful planning, disciplined saving, and smart investing. Here are some steps you can take to reach the 1 crore milestone with a 20,000 salary: Set a goal and create a plan: The first step towards achieving any financial goal is to set a specific target and create a plan to achieve it. Determine how much you need to save each month, how long it will take to reach your goal, and what steps you need to take to get there. Cut expenses and save aggressively: To reach the 1 crore milestone, you will need to save aggressively. This means cutting back on unnecessary expenses and putting as much money as possible towards your savings. Consider ways to reduce your rent, utilities, transportation, and food costs to free up more money for saving and investing. Invest in the stock market: Investing in the stock market is one of the most effective ways to grow your wealth over the long term. Even with a small salary, you can start investing in stocks through mutual funds, which allow you to pool your money with other investors to buy a diversified portfolio of stocks. Over time, the compounding effect of your investments can help you achieve your financial goals. Consider other investment options: In addition to stocks, there are other investment options that can help you grow your wealth, such as fixed deposits, real estate, and gold. Research these options and consider which ones are best suited to your financial goals and risk tolerance. Be disciplined and patient: Reaching the 1 crore milestone with a 20,000 salary will require discipline and patience. It may take years or even decades to reach your goal, but if you stay focused and committed, you can get there. In summary, reaching the 1 crore milestone with a 20,000 salary is possible, but it will require careful planning, disciplined saving, and smart investing. By setting a specific goal, cutting expenses, investing in the stock market, considering other investment options, and staying disciplined and patient, you can achieve your financial dreams.

Budgeting is an essential skill that everyone should learn. It helps you track your expenses, save money, and achieve your financial goals. However, creating a realistic budget is not enough. Sticking to it can be challenging, especially if you don’t have the discipline to follow through. In this blog, we will discuss how to make a realistic budget and how to stick to it. Step 1: Determine Your Income The first step in creating a budget is to determine your income. This includes all sources of income, such as your salary, bonuses, and side hustles. If you have a variable income, calculate an average based on the last few months. Once you have your total income, you can move on to the next step. Step 2: List Your Expenses The next step is to list all your expenses. This includes fixed expenses, such as rent, mortgage payments, and utility bills, and variable expenses, such as groceries, entertainment, and clothing. Don’t forget to include periodic expenses, such as car insurance and property taxes, that may not occur every month. Step 3: Categorize Your Expenses Once you have listed all your expenses, categorize them into essential and non-essential expenses. Essential expenses are those that you must pay to maintain your basic needs, such as food, shelter, and transportation. Non-essential expenses are those that you can live without, such as dining out and shopping. Step 4: Set Your Financial Goals The next step is to set your financial goals. Do you want to save for a down payment on a house, pay off your student loans, or build an emergency fund? Once you have set your financial goals, you can allocate a portion of your income towards achieving them. Step 5: Determine Your Budget Now that you have a clear understanding of your income, expenses, and financial goals, you can create a budget. Start by subtracting your essential expenses from your income. This will give you a clear picture of how much money you have left to spend on non-essential expenses and savings. Step 6: Monitor Your Spending Creating a budget is only the first step. To stick to your budget, you need to monitor your spending regularly. Use a budgeting app or a spreadsheet to track your expenses and compare them to your budget. This will help you identify areas where you are overspending and make adjustments accordingly. Step 7: Find Ways to Cut Costs If you find that you are overspending in certain areas, look for ways to cut costs. For example, you can reduce your dining out expenses by cooking at home more often or shop for groceries at a cheaper store. You can also cancel subscriptions that you don’t use or negotiate lower rates for your bills. Step 8: Reward Yourself Sticking to a budget can be challenging, but it’s important to reward yourself for your hard work. Set small goals and reward yourself when you achieve them. For example, if you save a certain amount of money, treat yourself to a nice dinner or buy something you’ve been wanting. In conclusion, creating a realistic budget and sticking to it requires discipline and commitment. By following these eight steps, you can create a budget that works for you and achieve your financial goals. Remember to monitor your spending regularly, look for ways to cut costs, and reward yourself for your hard work. With a little effort, you can take control of your finances and build a better future for yourself.

Investing can be a great way to grow your wealth over time. However, getting started can seem overwhelming, especially if you are new to the world of investing. In this blog post, we will provide a detailed guide on where to start investing. Determine your financial goals The first step in investing is to determine your financial goals. Are you investing for retirement? Do you want to save for a down payment on a house? Are you trying to pay off debt? Your financial goals will help you determine how much you need to invest, what types of investments to consider, and how long you can stay invested. Assess your risk tolerance Before you start investing, you need to assess your risk tolerance. Risk tolerance refers to your ability to tolerate market volatility and potential losses. If you are risk-averse, you may want to consider conservative investments, such as bonds or mutual funds. If you are more comfortable with risk, you may want to consider more aggressive investments, such as individual stocks. Start with a small amount When you are first starting out, it is important to start with a small amount of money. This will allow you to learn about investing without risking too much of your money. As you become more comfortable with investing, you can increase the amount you invest. Choose your investment account There are many types of investment accounts, such as individual retirement accounts (IRAs), 401(k)s, and brokerage accounts. Each type of account has its own rules and regulations, so it is important to choose the account that best fits your financial goals and investment strategy. Decide what to invest in Once you have determined your financial goals, assessed your risk tolerance, and chosen your investment account, it is time to decide what to invest in. There are many types of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Each type of investment has its own advantages and disadvantages, so it is important to do your research and choose investments that fit your financial goals and risk tolerance. Diversify your investments Diversification is the key to a successful investment portfolio. This means investing in a variety of assets to spread out your risk. By diversifying your investments, you can reduce the impact of market volatility and potential losses. Monitor your investments It is important to monitor your investments regularly to ensure they are performing as expected. This means reviewing your investment portfolio on a regular basis and making adjustments as necessary. You may also want to consult with a financial advisor to help you make informed investment decisions. In conclusion, investing can be a great way to grow your wealth over time. However, getting started can seem overwhelming. By following the steps outlined above, you can start investing with confidence and work towards achieving your financial goals. Remember, investing is a long-term game, and patience and persistence are key to success.

Managing your money is essential to your financial well-being. But it can be difficult to know where to start or how to manage your finances effectively. One strategy that has gained popularity over the years is the 50-30-20 rule. This rule helps you allocate your income in a way that prioritizes your financial goals while still allowing for some flexibility and discretionary spending. In this blog, we will explore what the 50-30-20 rule is and how you can use it to save and invest your money effectively. What is the 50-30-20 rule? The 50-30-20 rule is a simple budgeting strategy that divides your income into three categories: needs, wants, and savings. The rule suggests that you allocate 50% of your income towards your needs, 30% towards your wants, and 20% towards your savings. Needs: Your needs are essential expenses that you cannot live without, such as rent or mortgage payments, utilities, groceries, and transportation. It’s crucial to prioritize these expenses first and make sure they are covered before allocating money to anything else. Wants: Your wants are discretionary expenses, such as dining out, entertainment, and shopping. While these expenses are not necessary, they do contribute to your overall quality of life. The 30% allocation allows you to indulge in these expenses while still maintaining a reasonable level of financial responsibility. Savings: The savings category includes any money you set aside for your financial goals, such as emergency funds, retirement savings, or investment accounts. This category is essential to building wealth and achieving financial security over time. How to use the 50-30-20 rule to save and invest effectively: Determine your after-tax income: To use the 50-30-20 rule effectively, you need to know how much money you have available to allocate. Start by calculating your after-tax income, which is your take-home pay after taxes and other deductions. Allocate 50% of your income towards needs: Your needs should always come first. Allocate 50% of your after-tax income towards essential expenses like rent or mortgage payments, utilities, groceries, and transportation. Allocate 30% of your income towards wants: After covering your needs, allocate 30% of your after-tax income towards discretionary expenses like dining out, entertainment, and shopping. This category allows for some flexibility and indulgence while still maintaining financial responsibility. Allocate 20% of your income towards savings: Finally, allocate 20% of your after-tax income towards savings. This category includes any money you set aside for your financial goals, such as emergency funds, retirement savings, or investment accounts. Make sure to prioritize this category and automate your savings contributions to ensure you stay on track. Reevaluate and adjust as needed: It’s essential to regularly reevaluate your budget and adjust as needed. Life changes, and your financial goals may change over time, so it’s important to be flexible and make adjustments accordingly. Conclusion: The 50-30-20 rule is a simple and effective budgeting strategy that can help you manage your money effectively. By prioritizing your needs, allowing for some flexibility with your wants, and prioritizing your savings, you can achieve financial security and build wealth over time. Remember to regularly evaluate and adjust your budget as needed to ensure you stay on track to achieving your financial goals.