Are you tired of feeling like you’re always living paycheck to paycheck? Do you struggle to How to save money every month? If so, you’re not alone. Many people struggle with the same issue. Fortunately, there are steps you can take to save money and improve your financial situation.

Start with an Example

Now we can see a real-time example to save your money every month,

Do you like coffee? One practical example of how to save money is by cutting back on your daily coffee habit. If you’re used to buying a $4 coffee every day, that adds up to $120 per month. Instead, consider brewing your own coffee at home or at work. Invest in a good quality coffee maker and buy your favorite coffee beans in bulk. This way, you can still enjoy your morning cup of joe without spending a lot of money. Over the course of a year, this small change could save you up to $1,440!

Another practical example of how to save money is by buying generic or store-brand products instead of name-brand products. Often, the generic or store-brand products are just as good as the name-brand products, but at a much lower cost. You can save money on groceries, cleaning products, and other household items by choosing the generic or store-brand option. Over time, these small savings can add up to a significant amount of money.

Okay, Let’s get into this blog post, we’ll cover some practical tips on how to save money every month.

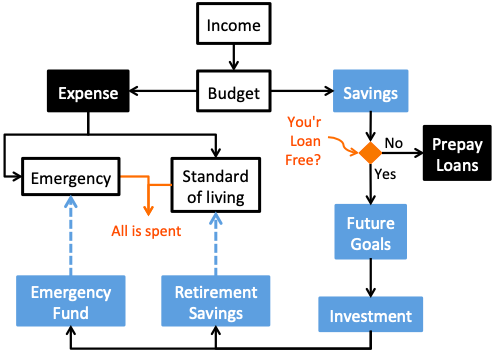

Create a budget

The first step to saving money is creating a budget. This will help you understand where your money is going each month and identify areas where you can cut back. Start by listing all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments. Then, compare your total expenses to your income. If you’re spending more than you’re earning, you’ll need to make some adjustments.

Use Spreadsheets or Budgeting application

creating a budget done by using a spreadsheet or budgeting app. Start by listing all of your monthly income sources, such as your salary, freelance work, or any other sources of income. Then, list all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any debt payments.

Assign a dollar amount to each expense category and subtract the total expenses from the total income to see if you have a surplus or deficit. This will give you a clear picture of where your money is going each month and where you may need to adjust your spending. You can also use a budgeting app like Mint or YNAB to automatically track your spending and categorize your expenses. This way, you can easily see how much you’re spending in each category and identify areas where you can cut back.

Cut back on unnecessary expenses

Once you’ve created a budget, look for ways to cut back on unnecessary expenses. For example, do you really need that gym membership you never use? Or, could you save money by cooking at home instead of eating out? Look for small changes you can make that will add up over time.

Set financial goals & save money

Setting financial goals is a great way to stay motivated and on track. Start by setting a savings goal for each month. This could be as simple as saving $50 or $100. As you become more comfortable with saving, you can increase your goals.

One practical example of setting financial goals is creating an emergency fund. This fund can be used to cover unexpected expenses, such as car repairs or medical bills, without having to rely on credit cards or loans. Start by setting a goal to save a certain amount, such as $1,000 or $2,000, and then make a plan to reach that goal. You can set up automatic transfers from your checking account to your emergency fund each month, or allocate a portion of your tax refund or bonus to the fund. By setting this financial goal and making a plan to achieve it, you’ll be prepared for unexpected expenses and avoid going into debt.

Use apps and tools to help you save money

There are many apps and tools available that can help you save money. For example, some apps will automatically save small amounts of money from your checking account each week. Others will help you find coupons and deals to save money on your purchases.

I will Suggest Wallet & Bluecoins Mobile applications to track your money. I’m using these two tools for the past two years. It’s amazing.

Pay yourself first

One of the most effective ways to save money is to pay yourself first. This means setting aside a portion of your income for savings before you pay your bills or spend money on anything else. Even if it’s just a small amount, paying yourself first will help you develop the habit of saving.

Conclusion: How to save money every month

| Expense Category | Monthly Expense | Money-Saving Strategies |

| Housing | $1,200 (rent) | Consider downsizing to a smaller apartment or finding a roommate to split rent costs. |

| Utilities | $150 | Turn off lights and electronics when not in use, adjust thermostat by a few degrees, switch to energy-efficient light bulbs. |

| Transportation | $200 | Carpool to work, walk or bike instead of driving short distances, use public transportation. |

| Food | $500 | Plan meals in advance and make a grocery list, cook at home instead of eating out, buy generic or store-brand products. |

| Entertainment | $100 | Look for free or low-cost activities, such as hiking or visiting museums, instead of expensive outings. |

| Total Monthly Expenses | $2,150 | Money-Saving Goal: Reduce monthly expenses by 10% by cutting back on unnecessary expenses and finding ways to save money. |

By identifying your monthly expenses and finding ways to reduce them, you can set a goal to save a certain percentage each month. In this example, the goal is to reduce monthly expenses by 10% and find ways to save money on housing, utilities, transportation, food, and entertainment. By tracking your expenses and sticking to your money-saving strategies, you can achieve your goal and save money every month.

In conclusion, saving money every month is possible if you’re willing to make some changes to your spending habits. By creating a budget, cutting back on unnecessary expenses, setting financial goals, using apps and tools to help you save, and paying yourself first, you’ll be on your way to a healthier financial future. So, start today and see how much you can save!

We sincerely hope that the article has provided valuable insights into the world of personal finance, and that you found the information presented to be helpful. By subscribing, you’ll receive regular updates and exclusive content that will help you stay on top of your finances and take control of your financial future. Thank you for choosing our blog as your go-to resource for all things personal finance, and we look forward to sharing more valuable information with you in the future.