Retirement Planning Mistakes to Avoid: Tips and Strategies for a Worry-Free Future

Retirement planning mistakes, Retirement is a time to enjoy the fruits of your labor and live the life you’ve always wanted. But without proper planning, retirement can quickly turn into a nightmare. To ensure a secure and worry-free future, it’s essential to avoid common retirement planning mistakes that can undermine your financial stability.

In this article, we’ll cover the top retirement planning mistakes to avoid and provide tips and strategies to help you make the most of your retirement savings. So, let’s get started!

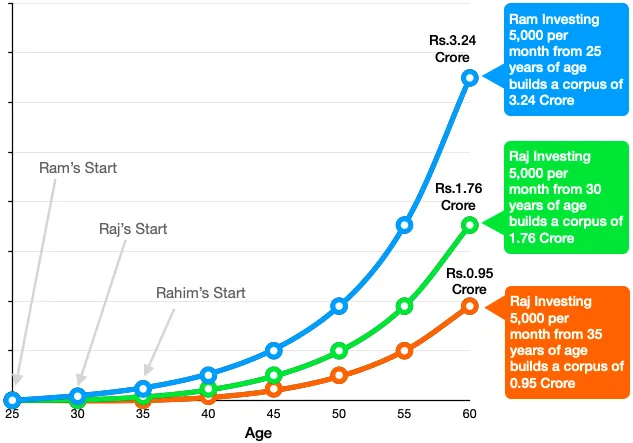

Mistake #1: Not starting early enough

One of the biggest mistakes people make when it comes to retirement planning is not starting early enough. It’s essential to start saving for retirement as early as possible to take advantage of the power of compound interest. Even small contributions can make a big difference over time.

Tip: Start contributing to a retirement savings account as soon as you start earning an income. Consider using tax-advantaged retirement accounts like a 401(k) or IRA to maximize your savings potential.

Mistake #2: Failing to plan for healthcare costs

Healthcare costs can quickly eat away at your retirement savings, especially as you age. Failing to plan for healthcare costs can leave you with little money to cover medical expenses, leading to financial stress and uncertainty.

Tip: Make sure to factor in healthcare costs when planning for retirement. Consider purchasing long-term care insurance or a Medicare supplement policy to help cover potential expenses.

Mistake #3: Underestimating retirement expenses

Many people make the mistake of underestimating how much money they’ll need in retirement. Failing to account for inflation and unexpected expenses can leave you with a retirement income shortfall.

Tip: Create a detailed retirement budget that accounts for all your expenses, including travel, hobbies, and healthcare costs. Don’t forget to factor in inflation and potential emergencies to ensure you have enough savings to last throughout your retirement.

Mistake #4: Taking on too much debt

Carrying too much debt into retirement can severely impact your financial stability. High-interest debt like credit card debt can quickly eat away at your savings, leaving you with little money to cover essential expenses.

Tip: Make a plan to pay off debt before retirement. Consider working with a financial advisor to develop a debt repayment plan that aligns with your retirement goals.

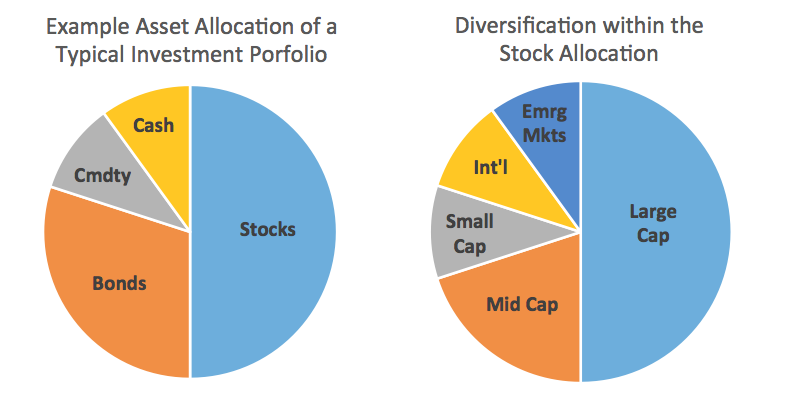

Mistake #5: Failing to diversify your investments

Investing all your retirement savings in one asset class can leave you vulnerable to market volatility and potential losses. Failing to diversify your investments can severely impact your retirement income and overall financial security.

Tip: Consider diversifying your retirement portfolio across multiple asset classes, such as stocks, bonds, and real estate. Make sure to rebalance your portfolio regularly to maintain your desired asset allocation.

Here’s an example of how you can save for retirement with calculations:

Let’s say you’re 25 years old and want to retire at age 65 with a retirement income of $60,000 per year in today’s dollars. Assuming a 3% inflation rate, your retirement income needs will be approximately $142,456 per year when you reach 65.

To calculate how much you need to save for retirement, you’ll need to consider several factors:

- Retirement income needs: As mentioned above, you’ll need approximately $142,456 per year in retirement income.

- Life expectancy: Assuming a life expectancy of 85, you’ll need to plan for 20 years of retirement.

- Rate of return: Assuming a conservative rate of return of 5%, you’ll need to save enough to generate $142,456 in annual income at retirement.

Using these factors, you can use a retirement calculator to determine how much you need to save each year to reach your retirement goals. Let’s assume that you plan to save for 40 years, starting at age 25 and ending at age 65.

Using a retirement calculator, you would need to save approximately $1,890 per month, or $22,680 per year, assuming a 5% rate of return. By the time you reach age 65, you will have saved approximately $907,200. Assuming a 4% withdrawal rate in retirement, you will be able to generate $36,288 in annual income, or approximately $3,024 per month.

Of course, this is just one example, and your retirement savings plan will depend on your individual circumstances, such as your current savings, your retirement goals, and your risk tolerance. It’s always a good idea to consult with a financial advisor who can help you create a customized retirement savings plan that meets your unique needs and circumstances.

In conclusion, retirement planning is essential for a worry-free future, but it’s crucial to avoid common mistakes that can undermine your financial security. By starting early, planning for healthcare costs, accounting for inflation and unexpected expenses, paying off debt, and diversifying your investments, you can secure your financial future and enjoy a worry-free retirement.

We hope Retirement planning tips has provided you with valuable insights and strategies to help you avoid retirement mistakes. If you have any questions or would like to learn more about retirement planning, please don’t hesitate to reach out to a qualified financial advisor.